Global Next-Generation IV Infusion Pumps Market Overview (2025–2032)

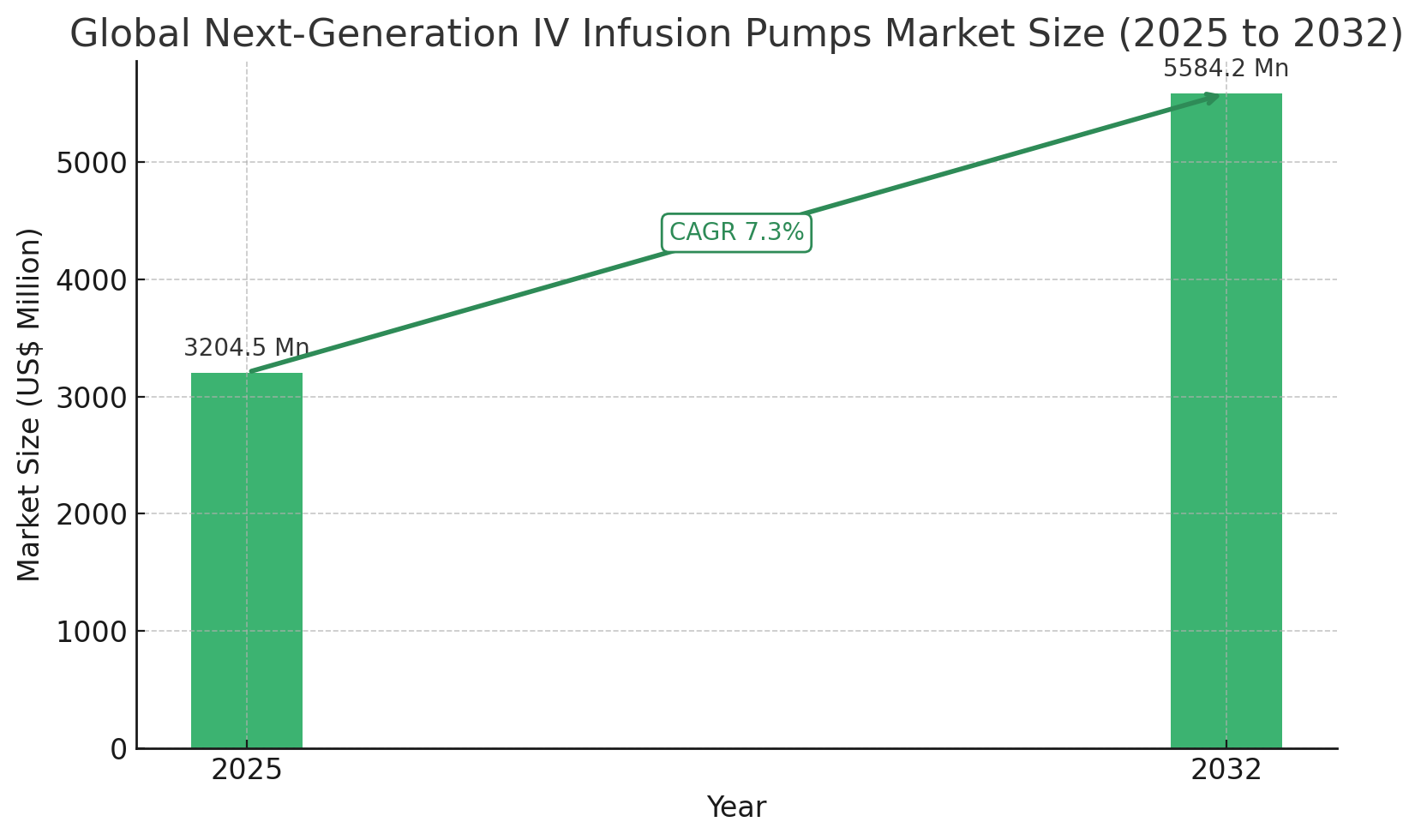

The global market for next-generation IV infusion pumps is projected to experience robust growth over the forecast period, expanding from USD 3.2 billion in 2025 to approximately USD 5.58 billion by 2032, reflecting a compound annual growth rate (CAGR) of 7.3%. This growth is primarily driven by the increasing adoption of smart infusion technologies across hospital, homecare, and ambulatory settings, combined with the rising burden of chronic illnesses and the demand for error-free drug delivery systems.

Infusion pumps are critical to modern medical care, enabling precise, controlled delivery of fluids, medications, and nutrients into a patient’s bloodstream. With growing technological advancements, the next generation of infusion pumps includes smart systems equipped with dose error reduction software (DERS), wireless connectivity, automated alerts, and integration with electronic health records (EHRs). These features reduce the risks of medication errors and improve overall patient outcomes.

Historically, from 2019 to 2024, the market grew at a CAGR of 5.8%, fueled by rising hospital admissions and increasing reliance on advanced intravenous therapies. In 2024 alone, large volumetric infusion systems represented approximately USD 982.6 million in value, with the overall market accounting for 6.6% of the global injectable drug delivery sector. As smart pump capabilities continue to evolve, their usage in perioperative and chronic care settings is accelerating, opening new avenues for product innovation and deployment.

A notable development is the increasing shift toward ambulatory and homecare settings, where wearable and portable infusion systems are transforming patient management. These solutions enable continuous drug delivery for conditions such as diabetes, cancer, and pain, thereby reducing hospital stays and improving patient convenience. The surge in demand for patient-controlled analgesia (PCA) systems and ambulatory infusion pumps is contributing significantly to market expansion.

Despite the promising outlook, the market faces challenges. Device recalls and software-related errors have affected user confidence and raised safety concerns. Design flaws such as software bugs, user interface complexities, power failures, and over-infusion events have prompted regulatory scrutiny. The U.S. FDA’s Infusion Pump Improvement Initiative, launched in 2010, aims to address these issues through collaborative device innovation, improved monitoring, and strict compliance standards.

Nevertheless, manufacturers are responding with continuous R&D efforts and smart feature enhancements. Smart infusion pumps are now being designed with automated drug libraries, real-time alerts, and compliance features to guide clinicians in safe medication administration. These improvements are particularly impactful in managing multi-drug therapies and titrated infusions.

Regionally, North America dominates the market, with the U.S. accounting for 84.8% of regional sales in 2024. The country’s strong healthcare infrastructure, technological leadership, and regulatory support have fueled widespread adoption of next-generation pumps. Continued investment in patient safety, led by the FDA and leading healthcare providers, will ensure North America remains at the forefront of this market.

In Europe, Germany holds a significant position, capturing 18.5% of the regional market. The country benefits from its aging population, advanced healthcare system, and commitment to pain management and chronic disease care. Healthcare digitization and increased funding are further boosting demand for smart infusion systems.

China leads East Asia, holding 54.2% of the market in 2024. Rising cancer prevalence, growing healthcare investment, and a rapidly aging population are key drivers. According to Cancer Communications, China recorded over 4.5 million new cancer cases in 2020, with over 3 million deaths, underscoring the urgent need for advanced drug delivery solutions in oncology care.

From a product standpoint, large volumetric infusion pumps dominate the global market, accounting for 33.3% of total value in 2024. These systems are essential for delivering fluids and medications in precise dosages, especially in critical care settings. They are widely used across hospitals, emergency units, outpatient infusion centers, and long-term care facilities.

In terms of applications, pain management leads with a 32.6% market share. The growing incidence of chronic pain disorders such as back pain, migraines, and neuropathy—alongside the global burden of diseases—has significantly increased the demand for PCA devices. These systems enable patients to self-administer controlled doses of analgesics, improving satisfaction and reducing workload on clinical staff.

Among end users, hospitals account for 39.3% of market share, valued at approximately USD 1.1 billion in 2024. This segment is expected to maintain dominance due to the high patient load, increased focus on medication safety, and implementation of cutting-edge infusion systems to reduce hospital stay duration and improve treatment accuracy.

The competitive landscape is moderately concentrated, with several key players actively investing in product innovation, geographic expansion, and strategic partnerships. Companies such as B. Braun Melsungen AG, Terumo Corporation, Baxter International, Medtronic, Zyno Medical, Fresenius Kabi, and BD (CareFusion) dominate the market.

Notable industry developments include:

-

In February 2021, B. Braun Medical Inc.’s Infusomat® Space® Large Volume Pump was awarded “Best in KLAS” for traditional smart pumps.

-

In June 2019, Ivenix received FDA clearance for its infusion system, developed to reduce common issues associated with legacy pump platforms.

-

Numerous players are integrating wireless technology, AI, and predictive analytics to advance infusion safety and optimize drug delivery practices.

In conclusion, the next-generation IV infusion pumps market is poised for strong growth, driven by innovation in smart technologies, increased focus on patient-centric care, and the rising need for safe, precise drug delivery systems across care settings. Continued investment in automation, miniaturization, and cloud integration will define the next wave of growth, making infusion therapy more accessible, efficient, and effective worldwide.

Table of Content

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Inclusions & Exclusions

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Key Brand Share/Preference of Equipment Installed

4.2. New Product Launches

4.3. Regulatory Scenario

4.4. Reimbursement Landscape

4.5. PESTLE Analysis

4.6. Porter’s Analysis

4.7. Value Chain Analysis

4.8. Key Promotional Strategies by Manufacturers

5. Market Background

5.1. Macro-Economic Factors

5.1.1. Global GDP Growth Outlook

5.1.2. Global Healthcare Expenditure

5.1.3. Global Injectable Drug Delivery Market Overview

5.2. Forecast Factors – Relevance & Impact

5.2.1. Top Companies Historical Growth

5.2.2. Technological Advancements in Next Generation IV Infusion Pumps

5.2.3. New Product Launches

5.2.4. Cost of Products

5.2.5. Rising Cardiac Diseases

5.2.6. Growing Adoption Rate

5.2.7. Strategic Mergers and Acquisitions Among Players

5.3. Market Dynamics

5.3.1. Drivers

5.3.2. Restraints

5.3.3. Opportunity Analysis

6. COVID-19 Crisis Analysis

6.1. COVID-19 and Impact Analysis

6.1.1. Revenue By Type of Pumps

6.1.2. Revenue By Application

6.1.3. Revenue By End User

6.1.4. Revenue By Region

6.2. 2022 Market Scenario

7. Global Next Generation IV Infusion Pumps Market Demand Volume Analysis 2019-2032

7.1. Historical Market Volume (Units) Analysis, 2019-2023

7.2. Current and Future Market Volume (Units) Projections, 2024-2032

7.2.1. Y-o-Y Growth Trend Analysis

8. Global Next Generation IV Infusion Pumps Market – Pricing Analysis

8.1. Regional Pricing Analysis By-Type of Pumps

8.2. Pricing Break Up

8.2.1. Manufacturer Level

8.2.2. Distributor Level

8.3. Global Average Pricing Analysis Benchmark

8.4. Pricing Assumptions

9. Global Next Generation IV Infusion Pumps Market Demand (in Value or Size in US$ Mn) Analysis 2019-2032

9.1. Historical Market Value (US$ Mn) Analysis, 2019-2023

9.2. Current and Future Market Value (US$ Mn) Projections, 2024-2032

9.2.1. Y-o-Y Growth Trend Analysis

9.2.2. Absolute $ Opportunity Analysis

10. Global Next Generation IV Infusion Pumps Market Analysis 2019-2032, By Type of Pumps

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis By Type of Pumps, 2019-2023

10.3. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis and Forecast By Type of Pumps, 2024-2032

10.3.1. Large Volumetric Infusion Systems

10.3.2. Syringe Infusion Systems

10.3.3. Electronic-Ambulatory Infusion Systems

10.3.4. Patient Controlled Analgesia Pumps

10.3.5. Disposable Elastomeric Infusion Systems

10.3.6. Implantable Infusion Systems

10.3.7. MRI-Compatible IV Infusion Systems

10.3.8. IV Disposables

10.4. Market Attractiveness Analysis By Type of Pumps

11. Global Next Generation IV Infusion Pumps Market Analysis 2019-2032, by Application

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) Analysis By Application, 2019-2023

11.3. Current and Future Market Size (US$ Mn) Analysis and Forecast By Application, 2024-2032

11.3.1. Clinical Nutrition

11.3.2. Pain Management

11.3.3. Chemotherapy

11.3.4. Antibiotic Management

11.3.5. Others

11.4. Market Attractiveness Analysis By Application

12. Global Next Generation IV Infusion Pumps Market Analysis 2019-2032, by End User

12.1. Introduction / Key Findings

12.2. Historical Market Size (US$ Mn) Analysis By End User, 2019-2023

12.3. Current and Future Market Size (US$ Mn) Analysis and Forecast By End User, 2024-2032

12.3.1. Hospitals

12.3.2. Ambulatory Surgical Centers

12.3.3. Homecare Settings

12.3.4. Diagnostic Centers

12.3.5. Others

12.4. Market Attractiveness Analysis By End User

13. Global Next Generation IV Infusion Pumps Market Analysis 2019-2032, by Region

13.1. Introduction

13.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Region, 2019-2023

13.3. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis and Forecast By Region, 2024-2032

13.3.1. North America

13.3.2. Latin America

13.3.3. Europe

13.3.4. East Asia

13.3.5. South Asia

13.3.6. Oceania

13.3.7. Middle East and Africa (MEA)

13.4. Market Attractiveness Analysis By Region

14. North America Next Generation IV Infusion Pumps Market Analysis 2019-2032

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Size (US$ Mn) and Volume (Units) Trend Analysis By Market Taxonomy, 2019-2023

14.4. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis Forecast By Market Taxonomy, 2024-2032

14.4.1. By Country

14.4.1.1. U.S.

14.4.1.2. Canada

14.4.2. By Type of Pumps

14.4.3. By Application

14.4.4. By End User

14.5. Market Attractiveness Analysis

14.5.1. By Country

14.5.2. By Type of Pumps

14.5.3. By Application

14.5.4. By End User

14.6. Key Market Participants – Intensity Mapping

14.7. Drivers and Restraints – Impact Analysis

14.8. Market Trends

14.9. Country Level Analysis & Forecast

14.9.1. U.S. Next Generation IV Infusion Pumps Market

14.9.1.1. Introduction

14.9.1.2. Market Analysis and Forecast by Market Taxonomy

14.9.1.2.1. By Type of Pumps

14.9.1.2.2. By Application

14.9.1.2.3. By End User

14.9.2. Canada Next Generation IV Infusion Pumps Market

14.9.2.1. Introduction

14.9.2.2. Market Analysis and Forecast by Market Taxonomy

14.9.2.2.1. By Type of Pumps

14.9.2.2.2. By Application

14.9.2.2.3. By End User

15. Latin America Next Generation IV Infusion Pumps Market Analysis 2019-2032

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ Mn) and Volume (Units) Trend Analysis By Market Taxonomy, 2019-2023

15.4. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis Forecast By Market Taxonomy, 2024-2032

15.4.1. By Country

15.4.1.1. Brazil

15.4.1.2. Mexico

15.4.1.3. Argentina

15.4.1.4. Rest of Latin America

15.4.2. By Type of Pumps

15.4.3. By Application

15.4.4. By End User

15.5. Market Attractiveness Analysis

15.5.1. By Country

15.5.2. By Type of Pumps

15.5.3. By Application

15.5.4. By End User

15.6. Key Market Participants – Intensity Mapping

15.7. Drivers and Restraints – Impact Analysis

15.8. Market Trends

15.9. Country Level Analysis & Forecast

15.9.1. Brazil Next Generation IV Infusion Pumps Market

15.9.1.1. Introduction

15.9.1.2. Market Analysis and Forecast by Market Taxonomy

15.9.1.2.1. By Type of Pumps

15.9.1.2.2. By Application

15.9.1.2.3. By End User

15.9.2. Argentina Next Generation IV Infusion Pumps Market

15.9.2.1. Introduction

15.9.2.2. Market Analysis and Forecast by Market Taxonomy

15.9.2.2.1. By Type of Pumps

15.9.2.2.2. By Application

15.9.2.2.3. By End User

15.9.3. Mexico Next Generation IV Infusion Pumps Market

15.9.3.1. Introduction

15.9.3.2. Market Analysis and Forecast by Market Taxonomy

15.9.3.2.1. By Type of Pumps

15.9.3.2.2. By Application

15.9.3.2.3. By End User

16. Europe Next Generation IV Infusion Pumps Market Analysis 2019-2032

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ Mn) and Volume (Units) Trend Analysis By Market Taxonomy, 2019-2023

16.4. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis Forecast By Market Taxonomy, 2024-2032

16.4.1. By Country

16.4.1.1. Germany

16.4.1.2. Italy

16.4.1.3. France

16.4.1.4. U.K.

16.4.1.5. Spain

16.4.1.6. BENELUX

16.4.1.7. Russia

16.4.1.8. Rest of Europe

16.4.2. By Type of Pumps

16.4.3. By Application

16.4.4. By End User

16.5. Market Attractiveness Analysis

16.5.1. By Country

16.5.2. By Type of Pumps

16.5.3. By Application

16.5.4. By End User

16.6. Key Market Participants – Intensity Mapping

16.7. Drivers and Restraints – Impact Analysis

16.8. Market Trends

16.9. Country Level Analysis & Forecast

16.9.1. Germany Next Generation IV Infusion Pumps Market

16.9.1.1. Introduction

16.9.1.2. Market Analysis and Forecast by Market Taxonomy

16.9.1.2.1. By Type of Pumps

16.9.1.2.2. By Application

16.9.1.2.3. By End User

16.9.2. France Next Generation IV Infusion Pumps Market

16.9.2.1. Introduction

16.9.2.2. Market Analysis and Forecast by Market Taxonomy

16.9.2.2.1. By Type of Pumps

16.9.2.2.2. By Application

16.9.2.2.3. By End User

16.9.3. Italy Next Generation IV Infusion Pumps Market

16.9.3.1. Introduction

16.9.3.2. Market Analysis and Forecast by Market Taxonomy

16.9.3.2.1. By Type of Pumps

16.9.3.2.2. By Application

16.9.3.2.3. By End User

16.9.4. Spain Next Generation IV Infusion Pumps Market

16.9.4.1. Introduction

16.9.4.2. Market Analysis and Forecast by Market Taxonomy

16.9.4.2.1. By Type of Pumps

16.9.4.2.2. By Application

16.9.4.2.3. By End User

16.9.5. U.K. Next Generation IV Infusion Pumps Market

16.9.5.1. Introduction

16.9.5.2. Market Analysis and Forecast by Market Taxonomy

16.9.6. BENELUX Next Generation IV Infusion Pumps Market

16.9.6.1. Introduction

16.9.6.2. Market Analysis and Forecast by Market Taxonomy

16.9.7. Russia Next Generation IV Infusion Pumps Market

16.9.7.1. Introduction

16.9.7.2. Market Analysis and Forecast by Market Taxonomy

17. South Asia Next Generation IV Infusion Pumps Market Analysis 2019-2032

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Size (US$ Mn) and Volume (Units) Trend Analysis By Market Taxonomy, 2019-2023

17.4. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis Forecast By Market Taxonomy, 2024-2032

17.4.1. By Country

17.4.1.1. India

17.4.1.2. Thailand

17.4.1.3. Indonesia

17.4.1.4. Malaysia

17.4.1.5. Rest of South Asia

17.4.2. By Type of Pumps

17.4.3. By Application

17.4.4. By End User

17.5. Market Attractiveness Analysis

17.5.1. By Country

17.5.2. By Type of Pumps

17.5.3. By Application

17.5.4. By End User

17.6. Key Market Participants – Intensity Mapping

17.7. Drivers and Restraints – Impact Analysis

17.8. Market Trends

17.9. Country Level Analysis & Forecast

17.9.1. India Next Generation IV Infusion Pumps Market

17.9.1.1. Introduction

17.9.1.2. Market Analysis and Forecast by Market Taxonomy

17.9.1.2.1. By Type of Pumps

17.9.1.2.2. By Application

17.9.1.2.3. By End User

17.9.2. Indonesia Next Generation IV Infusion Pumps Market

17.9.2.1. Introduction

17.9.2.2. Market Analysis and Forecast by Market Taxonomy

17.9.2.2.1. By Type of Pumps

17.9.2.2.2. By Application

17.9.2.2.3. By End User

17.9.3. Malaysia Next Generation IV Infusion Pumps Market

17.9.3.1. Introduction

17.9.3.2. Market Analysis and Forecast by Market Taxonomy

17.9.3.2.1. By Type of Pumps

17.9.3.2.2. By Application

17.9.3.2.3. By End User

17.9.4. Thailand Next Generation IV Infusion Pumps Market

17.9.4.1. Introduction

17.9.4.2. Market Analysis and Forecast by Market Taxonomy

17.9.4.2.1. By Type of Pumps

17.9.4.2.2. By Application

17.9.4.2.3. By End User

18. East Asia Next Generation IV Infusion Pumps Market Analysis 2019-2032

18.1. Introduction

18.2. Pricing Analysis

18.3. Historical Market Size (US$ Mn) and Volume (Units) Trend Analysis By Market Taxonomy, 2019-2023

18.4. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis Forecast By Market Taxonomy, 2024-2032

18.4.1. By Country

18.4.1.1. China

18.4.1.2. Japan

18.4.1.3. South Korea

18.4.2. By Type of Pumps

19. Appendix

19.1. Research Methodology

19.2. Research Assumptions

19.3. Acronyms and Abbreviation