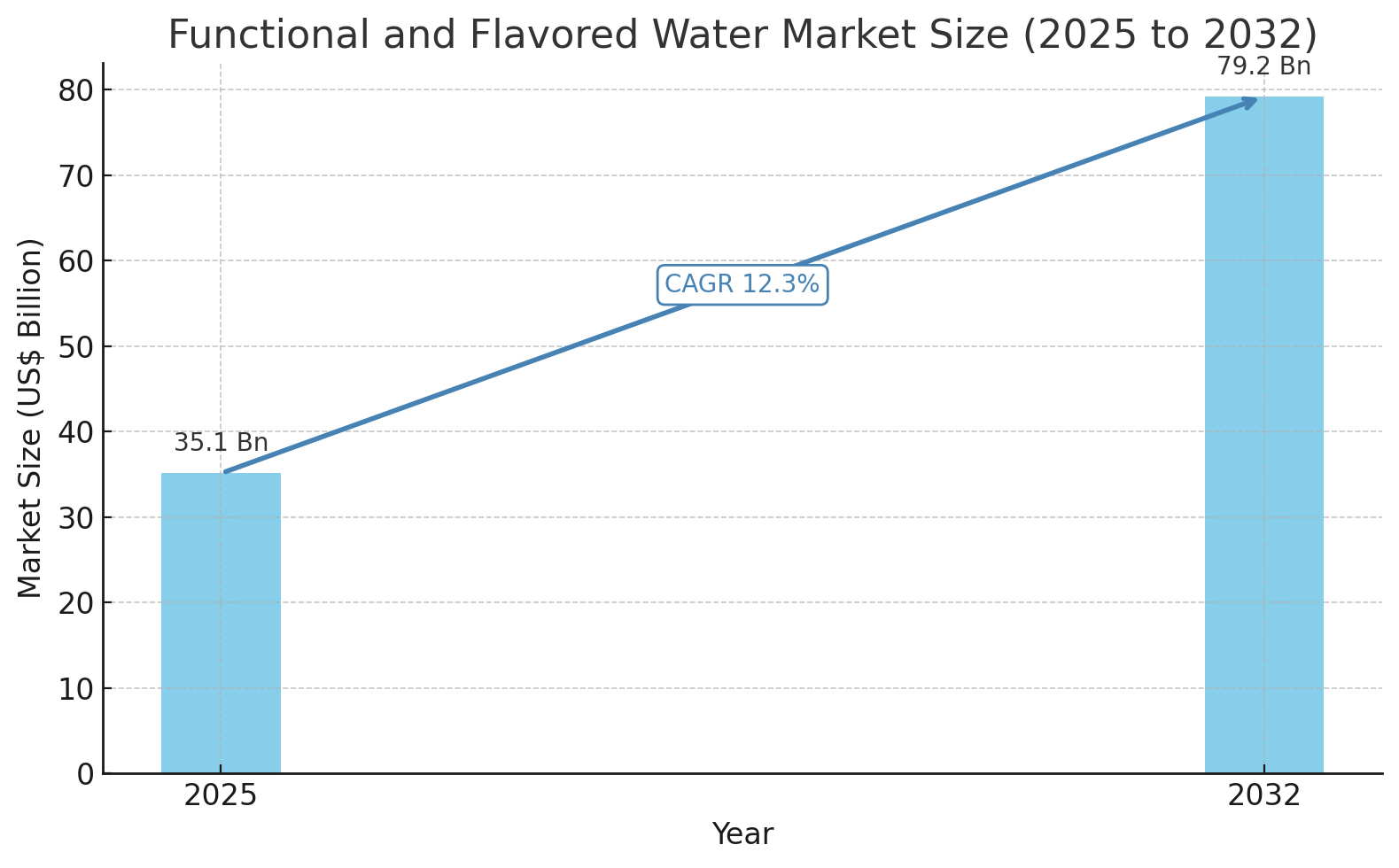

The global functional and flavored water market is expected to grow significantly, increasing from USD 35.1 billion in 2025 to approximately USD 79.2 billion by 2032, expanding at a robust compound annual growth rate (CAGR) of 12.3%. This projected expansion is driven by heightened consumer health consciousness, growing demand for low-calorie beverage alternatives, and a rising preference for enhanced hydration options. Between 2019 and 2024, the market recorded a CAGR of 8.2%, reaching USD 32.5 billion in 2024. As more consumers adopt wellness-focused lifestyles, flavored and functional water is becoming an essential substitute for traditional carbonated and sugary beverages.

Functional water is typically enriched with vitamins, minerals, electrolytes, herbs, or antioxidants, whereas flavored water incorporates natural or fruit-based flavorings without adding sugar or calories. The appeal lies in combining hydration with added health benefits, aligning with the demands of fitness-conscious and aging populations. The increase in urbanization, rising disposable incomes, and the expansion of modern retail formats also contribute to market acceleration. Functional and flavored waters are now seen as part of a broader healthy lifestyle movement, supported by influential marketing campaigns and growing product variety.

Consumer trends have shifted rapidly in favor of products perceived as natural, clean-label, and low in sugar. Health issues such as obesity, diabetes, and cardiovascular disorders have made many people reconsider their beverage choices. Functional and flavored water provides a convenient solution for consumers seeking both taste and nutrition. The trend is especially evident in urban centers where consumers are adopting preventive health measures and reducing consumption of synthetic beverages. Furthermore, younger consumers are especially drawn to refreshing flavored options, while older consumers prefer waters with added nutritional benefits.

Another contributing factor to market growth is the positioning of functional water within beauty and wellness routines. Many functional waters are now being marketed with cosmetic benefits such as improved skin hydration, detoxification, and anti-aging properties. In emerging economies, rising incomes are enabling consumers to explore premium health beverages that were previously unaffordable. This premiumization trend is especially prominent in countries experiencing environmental stressors such as water pollution, which has fueled packaged water consumption across Asia.

The taste factor also plays a key role in encouraging hydration. Flavored waters offer a sensory advantage over plain water, motivating consumers to drink more frequently throughout the day. Health professionals have noted that this increased fluid intake supports metabolic processes, weight management, and general wellness. This demand has led to increasing per capita consumption in developed and developing countries alike.

Nevertheless, the widespread use of plastic packaging presents a major challenge. Single-use plastic bottles are commonly used in this segment and have raised growing environmental concerns. Plastic waste, carbon footprints, and health risks associated with plastic leaching are under intense scrutiny. Regulatory restrictions and consumer pressure are pushing companies to adopt sustainable packaging alternatives, though the transition remains a gradual process.

Europe currently leads the global market, holding a 29.1% value share in 2024. France and Germany represent the largest national markets within the region, accounting for a combined one-third of Europe’s total consumption. The region benefits from high health literacy, widespread access to premium water products, and a supportive regulatory environment. North America follows as the second-largest regional market, contributing 22.3% of global revenue. Consumers in the U.S. and Canada are particularly responsive to health branding and low-sugar product claims. The rise of functional waters infused with electrolytes, probiotics, or vitamins is reshaping beverage shelves across the region.

Asia Pacific is emerging as the fastest-growing market, fueled by large-scale urbanization, changing dietary habits, and increased awareness of water quality. China, India, Japan, and South Korea are among the key contributors, with packaged water demand rising sharply due to pollution and health-related concerns. Latin America holds a relatively larger base than the Middle East and Africa, though the latter is projected to grow at a higher rate due to its evolving retail sector and rising wellness awareness.

Within product categories, functional water holds the largest market share and is expected to maintain its lead through 2032. The growth is attributed to innovations in formulation, health claims, and added benefits that align with specific lifestyle needs such as immunity boosting, digestive health, and energy enhancement. In contrast, flavored water continues to gain traction among consumers looking for taste variety without added sugars or calories.

In terms of distribution, hypermarkets and supermarkets dominate due to their extensive reach and high foot traffic. These outlets provide consumers with access to multiple brands and promotional offers. However, online retail is the fastest-growing sales channel, driven by the convenience of home delivery, subscription models, and a broader product assortment. E-commerce platforms are becoming especially relevant in urban and younger consumer segments.

The competitive landscape features a mix of multinational beverage corporations and agile start-ups. Leading players such as PepsiCo, Nestlé, Danone, The Coca-Cola Company, and Talking Rain Beverage Company are aggressively expanding their functional and flavored water portfolios. Product innovation is a key strategic focus, with efforts directed at enhancing taste, adding nutritional functionality, and transitioning to eco-friendly packaging.

Strategic partnerships and acquisitions are shaping the market’s trajectory. For instance, PepsiCo introduced Aquafina Sparkling to tap into the sparkling functional water segment, while Danone’s acquisition of Turkish water brand Sirma strengthened its regional presence. Coca-Cola formed a regional bottling alliance in Africa to streamline its distribution network. Nestlé Waters expanded its production facilities to meet growing demand for its Pure Life and flavored water lines.

As health and environmental consciousness continue to reshape consumer behavior, the functional and flavored water market is expected to grow in both volume and value. The sector’s long-term success will rely on balancing innovation with sustainability, affordability, and nutritional integrity. With rising global demand for healthy, convenient, and refreshing beverage options, functional and flavored water is poised to remain a key category in the wellness-oriented beverage landscape.

Functional and Flavored Water Industry Research by Category

By Product Type:

- Flavored Water

- Functional Water

By Sales Channel:

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Departmental Stores

- Online Retail

By Region:

- North America

- Latin America

- Europe

- South Asia & Pacific

- East Asia

- Middle East & Africa

Table of Content

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.1.1. Evolving Consumers Preference for Healthy Beverages – 21st Century Trend

3.1.2. Consumers View Water as an Integral part of Daily Nutrition to Augment Sales of Flavored & Functional Waters

3.1.3. Retail sector to register exceptionally high demand for flavored and functional waters

3.1.4. Others

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Consumer Trends Shaping the Industry

4.1.1. Who is Consuming is Transforming

4.1.2. Where & What is Consumed is Evolving

4.1.3. Why it is Being Consumed is Changing

5. Key Regulations & Label Claims

5.1. Packaging & Labelling Regulations

5.2. Region & Country Specific Regulations

5.3. Label Claims

6. Global Flavored and Functional Water Market Demand Outlook, 2019 – 2032

6.1. Historical Market Volume (Tons) Analysis, 2019-2023

6.2. Current and Future Market Volume (Tons) Projections, 2024-2032

6.2.1. Y-o-Y Growth Trend Analysis

7. Global Flavored and Functional Water Market – Pricing Analysis

7.1. Regional Pricing Trend Analysis

7.2. Global Average Pricing Analysis Benchmark

8. Global Flavored and Functional Water Market Demand Outlook, 2019 – 2032

8.1. Historical Market Value (US$ Mn) Analysis, 2019-2023

8.2. Current and Future Market Value (US$ Mn) Projections, 2024-2032

8.2.1. Y-o-Y Growth Trend Analysis

8.2.2. Absolute $ Opportunity Analysis

9. Market Background

9.1. Macro-Economic Factors

9.1.1. Global GDP Growth Outlook

9.1.2. Global Industry Value Added

9.1.3. Global Urbanization Growth Outlook

9.1.4. Global Food Security Index Outlook

9.1.5. Global Rank – Ease of Doing Business

9.1.6. Global Rank – Trading Across Borders

9.2. Processing Technology Overview

9.3. Global Bottled Water Market Outlook

9.4. Forecast Factors – Relevance & Impact

9.5. Market Dynamics

9.5.1. Drivers

9.5.2. Restraints

9.5.3. Opportunity Analysis

9.6. Global Supply Demand Analysis

10. Global Flavored and Functional Water Market Outlook, 2019 – 2032

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume Analysis By Product Type, 2019-2023

10.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Product Type, 2024-2032

10.3.1. Flavored Water

10.3.2. Functional Water

10.4. Market Attractiveness Analysis By Product Type

11. Global Flavored and Functional Water Market Outlook, 2019 – 2032

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) and Volume Analysis By Sales Channel, 2019-2023

11.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Sales Channel, 2024-2032

11.3.1. Hypermarkets/Supermarkets

11.3.2. Convenience Stores

11.3.3. Specialty Stores

11.3.4. Departmental Stores

11.3.5. Online Retail

11.4. Market Attractiveness Analysis By Sales Channel

12. Global Flavored and Functional Water Market Outlook, 2019 – 2032

12.1. Introduction

12.2. Historical Market Size (US$ Mn) and Volume Analysis By Region, 2019-2023

12.3. Current Market Size (US$ Mn) and Volume Analysis and Forecast By Region, 2024-2032

12.3.1. North America

12.3.2. Latin America

12.3.3. Europe

12.3.4. Middle East and Africa (MEA)

12.3.5. East Asia

12.3.6. South Asia and Pacific

12.4. Market Attractiveness Analysis By Region

13. North America Flavored and Functional Water Market Outlook, 2019 – 2032

13.1. Introduction

13.2. Pricing Analysis

13.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

13.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

13.4.1. By Country

13.4.1.1. U.S.

13.4.1.2. Canada

13.4.2. By Type

13.4.3. By Sales Channel

13.5. Market Attractiveness Analysis

13.5.1. By Country

13.5.2. By Type

13.5.3. By Sales Channel

13.6. Market Trends

13.7. Key Market Participants – Intensity Mapping

13.8. Drivers and Restraints – Impact Analysis

14. Latin America Flavored and Functional Water Market Outlook, 2019 – 2032

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

14.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

14.4.1. By Country

14.4.1.1. Brazil

14.4.1.2. Mexico

14.4.1.3. Argentina

14.4.1.4. Chile

14.4.1.5. Rest of Latin America

14.4.2. By Type

14.4.3. By Sales Channel

14.5. Market Attractiveness Analysis

14.5.1. By Country

14.5.2. By Type

14.5.3. By Sales Channel

14.6. Market Trends

14.7. Key Market Participants – Intensity Mapping

14.8. Drivers and Restraints – Impact Analysis

15. Europe Flavored and Functional Water Market Outlook, 2019 – 2032

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

15.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

15.4.1. By Country

15.4.1.1. Germany

15.4.1.2. Italy

15.4.1.3. France

15.4.1.4. U.K.

15.4.1.5. Spain

15.4.1.6. BENELUX

15.4.1.7. Russia

15.4.1.8. Poland

15.4.1.9. Nordic

15.4.1.10. Rest of Europe

15.4.2. By Type

15.4.3. By Sales Channel

15.5. Market Attractiveness Analysis

15.5.1. By Country

15.5.2. By Type

15.5.3. By Sales Channel

15.6. Market Trends

15.7. Key Market Participants – Intensity Mapping

15.8. Drivers and Restraints – Impact Analysis

16. South Asia and Pacific Flavored and Functional Water Market Outlook, 2019 – 2032

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

16.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

16.4.1. By Country

16.4.1.1. India

16.4.1.2. ASEAN

16.4.1.3. Oceania

16.4.1.4. Rest of South Asia & Pacific

16.4.2. By Type

16.4.3. By Sales Channel

16.5. Market Attractiveness Analysis

16.5.1. By Country

16.5.2. By Type

16.5.3. By Sales Channel

16.6. Market Trends

16.7. Key Market Participants – Intensity Mapping

16.8. Drivers and Restraints – Impact Analysis

17. East Asia Flavored and Functional Water Market Outlook, 2019 – 2032

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

17.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

17.4.1. By Country

17.4.1.1. China

17.4.1.2. Japan

17.4.1.3. South Korea

17.4.2. By Type

17.4.3. By Sales Channel

17.5. Market Attractiveness Analysis

17.5.1. By Country

17.5.2. By Type

17.5.3. By Sales Channel

17.6. Market Trends

17.7. Key Market Participants – Intensity Mapping

17.8. Drivers and Restraints – Impact Analysis

18. Middle East and Africa Flavored and Functional Water Market Outlook, 2019 – 2032

18.1. Introduction

18.2. Pricing Analysis

18.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

18.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

18.4.1. By Country

18.4.1.1. GCC Countries

18.4.1.2. Turkey

18.4.1.3. Northern Africa

18.4.1.4. South Africa

18.4.1.5. Egypt

18.4.1.6. Israel

18.4.1.7. Rest of Middle East and Africa

18.4.2. By Type

18.4.3. By Sales Channel

18.5. Market Attractiveness Analysis

18.5.1. By Country

18.5.2. By Type

18.5.3. By Sales Channel

18.6. Market Trends

18.7. Key Market Participants – Intensity Mapping

18.8. Drivers and Restraints – Impact Analysis

19. Country Wise Flavored and Functional Water Market Outlook, 2019 – 2032

19.1. Introduction

19.1.1. Market Value Proportion Analysis, By Key Countries

19.1.2. Global Vs. Country Growth Comparison

19.2. U.S. Flavored and Functional Water Market Analysis

19.2.1. By Type

19.2.2. By Sales Channel

19.3. Canada Flavored and Functional Water Market Analysis

19.3.1. By Type

19.3.2. By Sales Channel

19.4. Mexico Flavored and Functional Water Market Analysis

19.4.1. By Type

19.4.2. By Sales Channel

19.5. Brazil Flavored and Functional Water Market Analysis

19.5.1. By Type

19.5.2. By Sales Channel

19.6. Argentina Flavored and Functional Water Market Analysis

19.6.1. By Type

19.6.2. By Sales Channel

19.7. Chile Flavored and Functional Water Market Analysis

19.7.1. By Type

19.7.2. By Sales Channel

19.8. Germany Flavored and Functional Water Market Analysis

19.8.1. By Type

19.8.2. By Sales Channel

19.9. Italy Flavored and Functional Water Market Analysis

19.9.1. By Type

19.9.2. By Sales Channel

19.10. France Flavored and Functional Water Market Analysis

19.10.1. By Type

19.10.2. By Sales Channel

19.11. U.K. Flavored and Functional Water Market Analysis

19.11.1. By Type

19.11.2. By Sales Channel

19.12. Spain Flavored and Functional Water Market Analysis

19.12.1. By Type

19.12.2. By Sales Channel

19.13. Russia Flavored and Functional Water Market Analysis

19.13.1. By Type

19.13.2. By Sales Channel

19.14. China Flavored and Functional Water Market Analysis

19.14.1. By Type

19.14.2. By Sales Channel

19.15. Japan Flavored and Functional Water Market Analysis

19.15.1. By Type

19.15.2. By Sales Channel

19.16. S. Korea Flavored and Functional Water Market Analysis

19.16.1. By Type

19.16.2. By Sales Channel

19.17. India Flavored and Functional Water Market Analysis

19.17.1. By Type

19.17.2. By Sales Channel

19.18. Turkey Flavored and Functional Water Market Analysis

19.18.1. By Type

19.18.2. By Sales Channel

19.19. South Africa Flavored and Functional Water Market Analysis

19.19.1. By Type

19.19.2. By Sales Channel

19.20. Israel Flavored and Functional Water Market Analysis

19.20.1. By Type

19.20.2. By Sales Channel

19.21. Egypt Flavored and Functional Water Market Analysis

19.21.1. By Type

19.21.2. By Sales Channel

20. Market Structure Analysis

20.1. Market Analysis by Tier of Companies (Flavored and Functional Water)

20.2. Market Share Analysis of Top Players

20.3. Market Presence Analysis

21. Competition Analysis

21.1. Competition Dashboard

21.2. Competition Benchmarking

21.3. Competition Deep Dive

21.3.1. Talking Rain Beverage Company

21.3.1.1. Overview

21.3.1.2. Product Portfolio

21.3.1.3. Profitability by Market Segments (Product/Channel/Region)

21.3.1.4. Sales Footprint

21.3.1.5. Strategy Overview

21.3.2. HINJ7

21.3.2.1. Overview

21.3.2.2. Product Portfolio

21.3.2.3. Profitability by Market Segments (Product/Channel/Region)

21.3.2.4. Sales Footprint

21.3.2.5. Strategy Overview

21.3.3. Propel

21.3.3.1. Overview

21.3.3.2. Product Portfolio

21.3.3.3. Profitability by Market Segments (Product/Channel/Region)

21.3.3.4. Sales Footprint

21.3.3.5. Strategy Overview

21.3.4. Bai Brands, LLC

21.3.4.1. Overview

21.3.4.2. Product Portfolio

21.3.4.3. Profitability by Market Segments (Product/Channel/Region)

21.3.4.4. Sales Footprint

21.3.4.5. Strategy Overview

21.3.5. Body Armor Nutrition LLC

21.3.5.1. Overview

21.3.5.2. Product Portfolio

21.3.5.3. Profitability by Market Segments (Product/Channel/Region)

21.3.5.4. Sales Footprint

21.3.5.5. Strategy Overview

21.3.6. San Pellecrino Essenza

21.3.6.1. Overview

21.3.6.2. Product Portfolio

21.3.6.3. Profitability by Market Segments (Product/Channel/Region)

21.3.6.4. Sales Footprint

21.3.6.5. Strategy Overview

21.3.7. Bubbly

21.3.7.1. Overview

21.3.7.2. Product Portfolio

21.3.7.3. Profitability by Market Segments (Product/Channel/Region)

21.3.7.4. Sales Footprint

21.3.7.5. Strategy Overview

21.3.8. JUST WATER

21.3.8.1. Overview

21.3.8.2. Product Portfolio

21.3.8.3. Profitability by Market Segments (Product/Channel/Region)

21.3.8.4. Sales Footprint

21.3.8.5. Strategy Overview

21.3.9. Lemon Perfect

21.3.9.1. Overview

21.3.9.2. Product Portfolio

21.3.9.3. Profitability by Market Segments (Product/Channel/Region)

21.3.9.4. Sales Footprint

21.3.9.5. Strategy Overview

21.3.10. Spindrift Beverage Co., Inc.

21.3.10.1. Overview

21.3.10.2. Product Portfolio

21.3.10.3. Profitability by Market Segments (Product/Channel/Region)

21.3.10.4. Sales Footprint

21.3.10.5. Strategy Overview

21.3.11. Perrier

21.3.11.1. Overview

21.3.11.2. Product Portfolio

21.3.11.3. Profitability by Market Segments (Product/Channel/Region)

21.3.11.4. Sales Footprint

21.3.11.5. Strategy Overview

21.3.12. Alkazone

21.3.12.1. Overview

21.3.12.2. Product Portfolio

21.3.12.3. Profitability by Market Segments (Product/Channel/Region)

21.3.12.4. Sales Footprint

21.3.12.5. Strategy Overview

21.3.13. CORE

21.3.13.1. Overview

21.3.13.2. Product Portfolio

21.3.13.3. Profitability by Market Segments (Product/Channel/Region)

21.3.13.4. Sales Footprint

21.3.13.5. Strategy Overview

21.3.14. Essentia Water Inc.

21.3.14.1. Overview

21.3.14.2. Product Portfolio

21.3.14.3. Profitability by Market Segments (Product/Channel/Region)

21.3.14.4. Sales Footprint

21.3.14.5. Strategy Overview

21.3.15. NESTLE SPLASH

21.3.15.1. Overview

21.3.15.2. Product Portfolio

21.3.15.3. Profitability by Market Segments (Product/Channel/Region)

21.3.15.4. Sales Footprint

21.3.15.5. Strategy Overview

21.3.16. Pepsi Co

21.3.16.1. Overview

21.3.16.2. Product Portfolio

21.3.16.3. Profitability by Market Segments (Product/Channel/Region)

21.3.16.4. Sales Footprint

21.3.16.5. Strategy Overview

21.3.17. AHA

21.3.17.1. Overview

21.3.17.2. Product Portfolio

21.3.17.3. Profitability by Market Segments (Product/Channel/Region)

21.3.17.4. Sales Footprint

21.3.17.5. Strategy Overview

21.3.18. The Coca-Cola Company

21.3.18.1. Overview

21.3.18.2. Product Portfolio

21.3.18.3. Profitability by Market Segments (Product/Channel/Region)

21.3.18.4. Sales Footprint

21.3.18.5. Strategy Overview

21.3.19. Groupe Danone

21.3.19.1. Overview

21.3.19.2. Product Portfolio

21.3.19.3. Profitability by Market Segments (Product/Channel/Region)

21.3.19.4. Sales Footprint

21.3.19.5. Strategy Overview

21.3.20. New York Spring Water.

21.3.20.1. Overview

21.3.20.2. Product Portfolio

21.3.20.3. Profitability by Market Segments (Product/Channel/Region)

21.3.20.4. Sales Footprint

21.3.20.5. Strategy Overview

21.3.21. KRAFT Foods

21.3.21.1. Overview

21.3.21.2. Product Portfolio

21.3.21.3. Profitability by Market Segments (Product/Channel/Region)

21.3.21.4. Sales Footprint

21.3.21.5. Strategy Overview

22. Assumptions and Acronyms Used

23. Research Methodology