Market Introduction

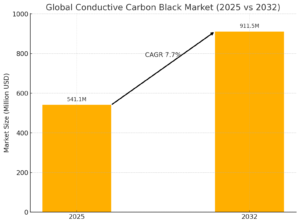

The global conductive carbon black market is positioned for robust growth over the forecast period of 2025 to 2032, with a projected Compound Annual Growth Rate (CAGR) of 7.7%. Persistence Market Research estimates the market value will reach approximately US$ 541.1 million by 2025 and expand further to US$ 909.5 million by 2032. This growth is driven by expanding applications across multiple industries and continuous production capacity enhancements by leading manufacturers.

Conductive carbon black, a highly refined form of carbon, is prized for its unique ability to enhance the mechanical and electrical properties of various materials. Its primary applications include reinforcing rubber, imparting conductivity to polymers, and enhancing durability and resistance properties in coatings and inks. Additionally, it is extensively used in the electronics sector, where it improves the conductivity of electrical components.

Historical Market Performance

Between 2019 and 2024, the conductive carbon black market experienced a moderate CAGR of 3.9%. Growth during this period was hampered by the global COVID-19 pandemic, which disrupted manufacturing operations, constrained supply chains, and significantly reduced demand across key end-use industries.

However, as global economies began to recover, demand for conductive carbon black rebounded strongly, particularly from sectors such as automotive, construction, paints and coatings, and electronics. This recovery established a firm foundation for the market’s accelerated growth trajectory forecasted for the 2025–2032 period.

Market Drivers

Rising Demand Across Application Segments

Conductive carbon black offers exceptional conductivity even at low concentrations, setting it apart from traditional carbon black. Its utility in applications such as electrical wire shielding, antistatic coatings, batteries, and thermoplastic composites is fueling market expansion. The rise in demand for electromagnetic interference (EMI) shielding materials, pressure sensors, and self-regulating heating materials is further driving consumption.

Research and Innovation as Growth Catalysts

Innovation is a critical growth lever. Manufacturers are actively developing new grades of conductive carbon black tailored for emerging applications. Initiatives such as tire recovery projects—where carbon black, oil, and steel are recovered—are gaining momentum. Furthermore, research into combining conductive carbon black with carbon nanotubes to improve electrode conductivity represents a promising avenue for expanding usage, especially in the energy storage sector.

Favorable Macroeconomic Trends

Investment in infrastructure, increased electric vehicle (EV) adoption, and growth in energy storage solutions globally are creating a conducive environment for conductive carbon black demand. These trends align with the broader transition toward sustainable and energy-efficient technologies.

Market Challenges

Competition from Alternative Materials

The emergence of alternatives such as silica, silicones, and bio-based lignin presents a significant threat to the conductive carbon black market. These alternatives offer improved environmental profiles and, in some cases, superior performance characteristics. For instance, ball-milled lignin has demonstrated higher surface area and conductivity than traditional conductive carbon black.

Health and Safety Concerns

Conductive carbon black poses potential health risks. Long-term exposure can irritate the respiratory tract, and it is classified as a possible human carcinogen. Occupational exposure limits impose restrictions, and increasing regulatory scrutiny could limit broader adoption in sensitive industries.

Application Analysis

Dominance of the Plastics Segment

The plastics segment is projected to maintain its dominance in terms of conductive carbon black consumption. Conductive carbon black enhances the static dissipation, UV resistance, and mechanical strength of plastic products used in automotive components, carrier boxes, tapes, trays, and packaging films. Its critical role in the manufacture of antistatic films, garbage bags, and insulation materials for wires and cables ensures sustained high demand in the plastics sector.

Regional Insights

United States: A Key Growth Market

The United States is expected to remain a significant contributor to the global conductive carbon black market, accounting for more than 20% of total sales by 2025. Post-pandemic economic recovery, coupled with investments in construction and battery manufacturing industries, is anticipated to drive demand. Additionally, higher operational costs, including the implementation of emission control systems, have contributed to price increases, making the market even more attractive for domestic production.

China: A Global Powerhouse

China remains a dominant player, contributing approximately 47% of East Asia’s conductive carbon black revenue. Despite recent challenges—such as decelerating automotive and construction industries and rising freight and production costs—China’s entrenched supply chains and manufacturing scale position it for strong recovery. Renewed domestic and international demand will likely support China’s leading role throughout the forecast period.

Germany: Leading in Europe

Germany stands out as the leading market within Europe. Its diversified industrial base, especially in automotive and manufacturing sectors, underpins strong demand for conductive carbon black. Germany is forecasted to offer significant absolute dollar opportunities between 2025 and 2032, reinforcing its strategic importance in the regional market landscape.

Competitive Landscape

The global conductive carbon black market is moderately consolidated, with the top 4–5 players controlling approximately 50–55% of market share. Major companies continue to focus on strategic initiatives such as capacity expansions, mergers and acquisitions, and technological advancements to strengthen their competitive positions.

Key Recent Developments:

-

Orion Engineered Carbon: In August 2021, Orion commenced construction of its second Chinese plant dedicated to specialty and high-performance carbon black, aiming to add 65–70 kilotons of capacity annually.

-

Imerys Graphite and Carbon: In October 2022, Imerys expanded its presence in India by opening a new plant in Andhra Pradesh, positioning itself to meet growing local demand.

Leading companies are investing aggressively in R&D, expanding regional footprints, and seeking partnerships to capture emerging opportunities, especially in rapidly industrializing regions such as South Asia and Latin America.

Future Opportunities

Automotive and EV Industry

The accelerating shift towards electric vehicles and hybrid mobility solutions will generate substantial new demand for conductive carbon black, particularly in battery electrodes and lightweight automotive components requiring EMI shielding.

Energy Storage Solutions

Expanding renewable energy installations and the need for advanced battery technologies present significant growth prospects. Conductive carbon black’s role in improving battery performance and lifespan will be increasingly vital.

Sustainable and Circular Economy Trends

Innovations focused on recycling and reusing conductive carbon black, such as recovered carbon black (rCB) from end-of-life tires, align with global sustainability goals. These developments are expected to open up new revenue streams and enhance the environmental appeal of conductive carbon black products.

Conclusion

The global conductive carbon black market is on a dynamic growth path, underpinned by robust demand across diverse industries, technological advancements, and favorable macroeconomic trends. While challenges related to competition from alternative materials and regulatory concerns persist, proactive innovation, strategic investments, and a focus on sustainable practices are expected to secure conductive carbon black’s pivotal role in the materials industry over the coming decade.

Table of Content

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Technology Roadmap

1.5. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

4.3. Strategic Promotional Strategies

5. Global Market Demand Analysis 2019-2023 and Forecast, 2024-2032

5.1. Historical Market Volume (Tons) Analysis, 2019-2023

5.2. Current and Future Market Volume (Tons) Projections, 2024-2032

5.3. Y-o-Y Growth Trend Analysis

6. Global Market – Pricing Analysis

6.1. Regional Pricing Analysis by Product Application

6.2. Global Average Pricing Analysis Benchmark

7. Global Market Demand (in Value or Size in US$ Mn) Analysis 2019-2023 and Forecast, 2024-2032

7.1. Historical Market Value (US$ Mn) Analysis, 2019-2023

7.2. Current and Future Market Value (US$ Mn) Projections, 2024-2032

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Macro-Economic Factors

8.1.1. Global GDP Growth Outlook

8.1.2. Other Macro Economic Factors

8.2. Forecast Factors – Relevance & Impact

8.2.1. Plastic Market Analysis

8.2.2. Effects of Acquisitions & Mergers on Market

8.2.3. Growing Demand from Battery Manufacturers

8.2.4. Construction Industry Growth

8.2.5. Demand from Paints and Coating Industry

8.3. Value Chain

8.3.1. Raw Material Suppliers

8.3.2. Product Manufacturers

8.3.3. End Users

8.4. COVID-19 Crisis – Impact Assessment

8.4.1. Current Statistics

8.4.2. Short-Mid-Long Term Outlook

8.4.3. Likely Rebound

8.5. Market Dynamics

8.5.1. Drivers

8.5.2. Restraints

8.5.3. Opportunity Analysis

8.6. Global Supply Demand Analysis

8.7. Overview by Key Types

8.7.1. Acetylene Black

8.7.2. Ketjen Black

9. Global Market Outlook, 2019 – 2032, by Application

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Mn) and Volume Analysis by Application, 2019-2023

9.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast by Application, 2024-2032

9.3.1. Plastic

9.3.2. Battery Electrode

9.3.3. Paints and Coatings

9.3.4. Rubber

9.3.5. Others

9.4. Market Attractiveness Analysis by Application

10. Global Conductive Carbon Black Market Outlook, 2019 – 2032, by Region

10.1. Introduction

10.2. Historical Market Size (US$ Mn) and Volume Analysis by Region, 2019-2023

10.3. Current Market Size (US$ Mn) and Volume Analysis and Forecast by Region, 2024-2032

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. East Asia

10.3.5. South Asia Pacific

10.3.6. Middle East and Africa

10.4. Market Attractiveness Analysis by Region

11. North America Market Outlook, 2019 – 2032

11.1. Introduction

11.2. Pricing Analysis

11.3. Historical Market Size (US$ Mn) and Volume Trend Analysis by Market Taxonomy, 2019-2023

11.4. Market Size (US$ Mn) and Volume Forecast by Market Taxonomy, 2024-2032

11.4.1. by Country

11.4.1.1. U.S.

11.4.1.2. Canada

11.4.2. by Application

11.5. Market Attractiveness Analysis

11.5.1. by Country

11.5.2. by Application

11.6. Market Trends

11.7. Key Market Participants – Intensity Mapping

11.8. Drivers and Restraints – Impact Analysis

12. Latin America Market Outlook, 2019 – 2032

12.1. Introduction

12.2. Pricing Analysis

12.3. Historical Market Size (US$ Mn) and Volume Trend Analysis by Market Taxonomy, 2019-2023

12.4. Market Size (US$ Mn) and Volume Forecast by Market Taxonomy, 2024-2032

12.4.1. by Country

12.4.1.1. Brazil

12.4.1.2. Mexico

12.4.1.3. Rest of Latin America

12.4.2. by Application

12.5. Market Attractiveness Analysis

12.5.1. by Country

12.5.2. by Application

12.6. Market Trends

12.7. Key Market Participants – Intensity Mapping

12.8. Drivers and Restraints – Impact Analysis

13. Europe Market Outlook, 2019 – 2032

13.1. Introduction

13.2. Pricing Analysis

13.3. Historical Market Size (US$ Mn) and Volume Trend Analysis by Market Taxonomy, 2019-2023

13.4. Market Size (US$ Mn) and Volume Forecast by Market Taxonomy, 2024-2032

13.4.1. by Country

13.4.1.1. Germany

13.4.1.2. Italy

13.4.1.3. France

13.4.1.4. U.K.

13.4.1.5. Spain

13.4.1.6. BENELUX

13.4.1.7. Russia

13.4.1.8. Rest of Europe

13.4.2. by Application

13.5. Market Attractiveness Analysis

13.5.1. by Country

13.5.2. by Application

13.6. Market Trends

13.7. Key Market Participants – Intensity Mapping

13.8. Drivers and Restraints – Impact Analysis

14. East Asia Market Outlook, 2019 – 2032

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Size (US$ Mn) and Volume Trend Analysis by Market Taxonomy, 2019-2023

14.4. Market Size (US$ Mn) and Volume Forecast by Market Taxonomy, 2024-2032

14.4.1. by Country

14.4.1.1. China

14.4.1.2. Japan

14.4.1.3. South Korea

14.4.2. by Application

14.5. Market Attractiveness Analysis

14.5.1. by Country

14.5.2. by Application

14.6. Market Trends

14.7. Key Market Participants – Intensity Mapping

14.8. Drivers and Restraints – Impact Analysis

15. South Asia and Pacific Market Outlook, 2019 – 2032

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ Mn) and Volume Trend Analysis by Market Taxonomy, 2019-2023

15.4. Market Size (US$ Mn) and Volume Forecast by Market Taxonomy, 2024-2032

15.4.1. by Country

15.4.1.1. India

15.4.1.2. ASEAN

15.4.1.3. Australia and New Zealand

15.4.1.4. Rest of South Asia & Pacific

15.4.2. by Application

15.5. Market Attractiveness Analysis

15.5.1. by Country

15.5.2. by Application

15.6. Market Trends

15.7. Key Market Participants – Intensity Mapping

15.8. Drivers and Restraints – Impact Analysis

16. Middle East and Africa Market Outlook, 2019 – 2032

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ Mn) and Volume Trend Analysis by Market Taxonomy, 2019-2023

16.4. Market Size (US$ Mn) and Volume Forecast by Market Taxonomy, 2024-2032

16.4.1. by Country

16.4.1.1. GCC Countries

16.4.1.2. Turkey

16.4.1.3. Northern Africa

16.4.1.4. South Africa

16.4.1.5. Rest of Middle East and Africa

16.4.2. by Application

16.5. Market Attractiveness Analysis

16.5.1. by Country

16.5.2. by Application

16.6. Market Trends

16.7. Key Market Participants – Intensity Mapping

16.8. Drivers and Restraints – Impact Analysis

17. Country-Wise Market Analysis 2024 to 2032

17.1. U.S. Market Analysis

17.1.1. by Application

17.2. Canada Market Analysis

17.2.1. by Application

17.3. Mexico Market Analysis

17.3.1. by Application

17.4. Brazil Market Analysis

17.4.1. by Application

17.5. Germany Market Analysis

17.5.1. by Application

17.6. Italy Market Analysis

17.6.1. by Application

17.7. France Market Analysis

17.7.1. by Application

17.8. U.K. Market Analysis

17.8.1. by Application

17.9. Spain Market Analysis

17.9.1. by Application

17.10. Russia Market Analysis

17.10.1. by Application

17.11. China Market Analysis

17.11.1. by Application

17.12. Japan Market Analysis

17.12.1. by Application

17.13. S. Korea Market Analysis

17.13.1. by Application

17.14. India Market Analysis

17.14.1. by Application

17.15. ASEAN Market Analysis

17.15.1. by Application

17.16. Australia and New Zealand Market Analysis

17.16.1. by Application

17.17. Turkey Market Analysis

17.17.1. by Application

17.18. South Africa Market Analysis

17.18.1. by Application

18. Market Structure Analysis

18.1. Market Analysis by Tier of Companies (Conductive Carbon Black)

18.2. Market Share Analysis of Top Players

18.3. Market Presence Analysis

19. Competition Analysis

19.1. Competition Dashboard

19.2. Competition Benchmarking

19.3. Competition Deep Dive

19.3.1. AkzoNobel N.V.

19.3.1.1. Overview

19.3.1.2. Product Portfolio

19.3.1.3. Profitability by Market Segments (Product/Channel/Region)

19.3.1.4. Sales Footprint

19.3.1.5. Strategy Overview

19.3.2. Orion Engineered Carbon

19.3.2.1. Overview

19.3.2.2. Product Portfolio

19.3.2.3. Profitability by Market Segments (Product/Channel/Region)

19.3.2.4. Sales Footprint

19.3.2.5. Strategy Overview

19.3.3. Cabot Corporation

19.3.3.1. Overview

19.3.3.2. Product Portfolio

19.3.3.3. Profitability by Market Segments (Product/Channel/Region)

19.3.3.4. Sales Footprint

19.3.3.5. Strategy Overview

19.3.4. Denka Company Ltd.

19.3.4.1. Overview

19.3.4.2. Product Portfolio

19.3.4.3. Profitability by Market Segments (Product/Channel/Region)

19.3.4.4. Sales Footprint

19.3.4.5. Strategy Overview

19.3.5. Tokai Carbon Co. Ltd.

19.3.5.1. Overview

19.3.5.2. Product Portfolio

19.3.5.3. Profitability by Market Segments (Product/Channel/Region)

19.3.5.4. Sales Footprint

19.3.5.5. Strategy Overview

19.3.6. Phillips Carbon Black Limited

19.3.6.1. Overview

19.3.6.2. Product Portfolio

19.3.6.3. Profitability by Market Segments (Product/Channel/Region)

19.3.6.4. Sales Footprint

19.3.6.5. Strategy Overview

19.3.7. Imerys Graphite and Carbon

19.3.7.1. Overview

19.3.7.2. Product Portfolio

19.3.7.3. Profitability by Market Segments (Product/Channel/Region)

19.3.7.4. Sales Footprint

19.3.7.5. Strategy Overview

19.3.8. Ampact Corporation

19.3.8.1. Overview

19.3.8.2. Product Portfolio

19.3.8.3. Profitability by Market Segments (Product/Channel/Region)

19.3.8.4. Sales Footprint

19.3.8.5. Strategy Overview

19.3.9. Birla Carbon

19.3.9.1. Overview

19.3.9.2. Product Portfolio

19.3.9.3. Profitability by Market Segments (Product/Channel/Region)

19.3.9.4. Sales Footprint

19.3.9.5. Strategy Overview

19.3.10. Asbury Corporation

19.3.10.1. Overview

19.3.10.2. Product Portfolio

19.3.10.3. Profitability by Market Segments (Product/Channel/Region)

19.3.10.4. Sales Footprint

19.3.10.5. Strategy Overview

19.3.11. Penta Carbon GmbH

19.3.11.1. Overview

19.3.11.2. Product Portfolio

19.3.11.3. Profitability by Market Segments (Product/Channel/Region)

19.3.11.4. Sales Footprint

19.3.11.5. Strategy Overview

19.3.12. Mitsubishi Chemical Corporation

19.3.12.1. Overview

19.3.12.2. Product Portfolio

19.3.12.3. Profitability by Market Segments (Product/Channel/Region)

19.3.12.4. Sales Footprint

19.3.12.5. Strategy Overview

20. Assumptions and Acronyms Used

21. Research Methodology

Report Purchase Information

| Attribute | Details |

|---|---|

| Report Price | USD 4,995 |

| Published Date | 28 April 2025 |

| Delivery Format | PDF & Excel |

| Number of Pages | 200 pages |

| Delivery Lead Time | Within 3 working days |

For direct email inquiries, please contact us at:

📩 mr@marketresearch.co.jp