Global Clinical Trial Imaging Market Overview (2025–2032)

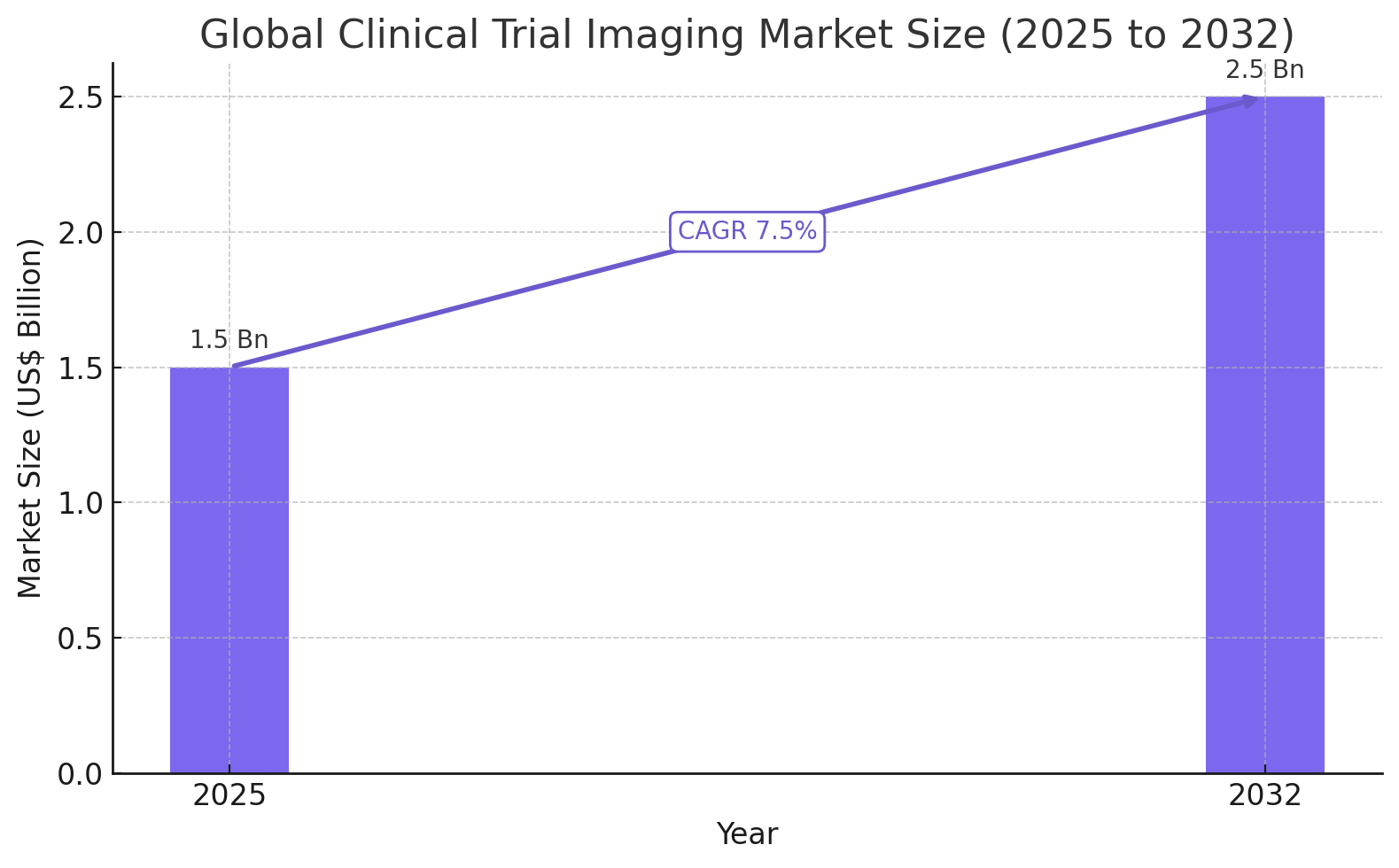

The global clinical trial imaging market is projected to expand from USD 1.5 billion in 2025 to approximately USD 2.5 billion by 2032, growing at a compound annual growth rate (CAGR) of 7.5% over the forecast period. This growth is driven by the rising volume of clinical trials, increasing demand for precision medicine, advancements in imaging technologies, and the growing adoption of decentralized and hybrid clinical trials.

Clinical trial imaging plays a vital role in drug development and medical research by providing detailed visual data to evaluate treatment safety, efficacy, and disease progression. According to the World Health Organization, nearly 40,000 clinical trials were conducted globally in 2024, highlighting the market’s expanding application across therapeutic areas such as oncology, neurology, and cardiology.

The market comprises multiple imaging modalities, including CT scans, MRI, X-rays, ultrasound, and PET/SPECT, which are integral to patient monitoring and outcome assessment. X-rays remain the most widely used imaging method, accounting for 21% of the market due to their accessibility and diagnostic efficiency. Meanwhile, oncology dominates by therapeutic application, as clinical trials for cancer treatment continue to expand globally.

From 2019 to 2024, the market saw a CAGR of 7.3%, supported by rapid advancements in imaging technologies, AI integration, and digital infrastructure in clinical research. Looking ahead, the widespread use of AI-powered imaging biomarkers, cloud-based imaging platforms, and decentralized clinical trials will define the future of the industry.

A significant trend shaping the market is the rise of remote imaging solutions driven by virtual and hybrid trial models. Cloud-based imaging tools allow researchers and clinicians to collect, analyze, and share imaging data in real time from remote locations, increasing trial accessibility and reducing logistical costs. This shift is improving trial efficiency, enhancing patient recruitment, and enabling broader geographic coverage. Industry research indicates that 70% of pharmaceutical sponsors plan to implement hybrid or decentralized trials in the next year, particularly in oncology, infectious diseases, and rare disease research.

However, the market faces challenges stemming from high costs associated with advanced imaging equipment and operations. Modalities like MRI and PET require expensive infrastructure, skilled personnel, and continuous maintenance, which can limit adoption, especially in emerging markets. These cost pressures may delay clinical trials and reduce the deployment of AI-enhanced imaging systems in lower-income regions.

Nonetheless, innovation in mobile imaging units, cloud platforms, and AI-powered diagnostics is rapidly improving scalability and cost-efficiency. A major opportunity lies in the growth of decentralized and hybrid clinical trials, which rely on flexible imaging technologies to reach underserved populations and streamline data collection.

For example, in March 2023, Clario launched a cloud-based Image Viewer platform that enables sponsors and CROs to access trial images securely in real time, illustrating the push toward digitization and global accessibility.

By region, North America leads the global clinical trial imaging market with a 28% share, driven by strong R&D investment, regulatory support, and the presence of major pharmaceutical companies and contract research organizations (CROs). The U.S., in particular, accounted for 20.5% of global clinical trials in 2024. According to CMS, U.S. healthcare spending reached USD 4.9 trillion in 2023, reinforcing the nation’s leadership in clinical innovation and imaging adoption.

Europe holds a substantial market share, supported by a robust regulatory framework, including the EU Clinical Trials Regulation (CTR) and comprehensive guidance from the European Medicines Agency (EMA). The region continues to support imaging technology advancements, with over 44,000 clinical trials registered in the EU in 2024, many of which depend on imaging for evaluation and regulatory approval.

Asia Pacific is the fastest-growing regional market, fueled by a sharp increase in clinical trial activity and improving healthcare infrastructure. China and India alone accounted for more than 43% of global clinical trials in 2024, making them critical hubs for outsourced research. Lower costs, faster patient recruitment, and growing investment in biotechnology are making the region attractive for global pharmaceutical sponsors seeking to expand their imaging capabilities.

Within the modality segment, X-ray imaging continues to dominate due to its cost-effectiveness and reliability for real-time diagnostics. For example, Shimadzu’s launch of the RADspeed Pro SR5 in March 2024 introduced advanced automation and digital radiography (DR) capabilities, underscoring continued innovation in traditional imaging tools.

In terms of therapeutic areas, oncology leads with a 23% market share, supported by the global rise in cancer incidence and increased R&D investment in cancer treatment. According to the World Cancer Research Fund, nearly 20 million new cancer cases were reported in 2022, prompting a surge in clinical trials focused on early detection and personalized medicine. Companies like Quibim are developing AI-powered imaging models for oncology, neurology, and immunology—driving transformative applications in imaging analytics.

The competitive landscape features a mix of large imaging service providers, software developers, and CROs. Notable players include Ixico PLC, Navitas Life Sciences, Resonance Health, Radiant Sage, WCG Clinical, Parexel, Clario, Invicro, and Calyx, among others. These companies are investing heavily in AI integration, cloud deployment, and service expansion to meet the growing complexity and volume of clinical trials.

Recent developments include:

-

Isotropic’s 2025 clinical trial for its IzoView Breast CT System, a 3D mammography solution for patients with dense breast tissue.

-

Pie Medical Imaging’s completion of patient enrollment for the FASTIII study, evaluating angiography-based vessel analysis.

-

Siemens Healthineers and Blue Earth Diagnostics collaborating to develop AI tools for PET imaging applications.

-

A joint initiative by ARPA-H and the FDA to create a Medical Imaging Data Marketplace (MIDM) for AI and machine learning innovation.

Looking ahead, the clinical trial imaging market will continue to evolve with increased reliance on digital platforms, precision imaging, and global patient inclusion strategies. As sponsors and CROs expand their use of imaging in regulatory submissions and drug development pipelines, the market is set for substantial growth, greater interoperability, and enhanced trial outcomes worldwide.

Table of Content

- Executive Summary

- Global Clinical Trial Imaging Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 – 2032, US$ Mn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- Macro-Economic Factors

- Global Sectorial Outlook

- Global GDP Growth Outlook

- COVID-19 Impact Analysis

- Forecast Factors – Relevance and Impact

- Value Added Insights

- Product & Services Adoption Analysis

- Regulatory Landscape

- Value Chain Analysis

- Key Deals and Mergers

- PESTLE Analysis

- Porter’s Five Force Analysis

- Price Trend Analysis, 2019 – 2032

- Key Highlights

- Key Factors Impacting Product & Services Prices

- Pricing Analysis By Product & Services

- Regional Prices and Product & Services Preferences

- Global Clinical Trial Imaging Market Outlook:

- Key Highlights

- Market Volume (Units) Projections

- Market Size (US$ Mn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Mn) Analysis and Forecast

- Historical Market Size (US$ Mn) Analysis, 2019-2023

- Current Market Size (US$ Mn) Analysis and Forecast, 2024-2032

- Global Clinical Trial Imaging Market Outlook: Product & Services

- Introduction / Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Product & Services, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Product & Services, 2024-2032

- Services

- Software

- Market Attractiveness Analysis: Product & Services

- Global Clinical Trial Imaging Market Outlook: Modality

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis, By Modality, 2019-2023

- Current Market Size (US$ Mn) Analysis and Forecast, By Modality, 2024-2032

- CT scan

- MRI

- X-Ray

- Market Attractiveness Analysis: Modality

- Global Clinical Trial Imaging Market Outlook: Therapeutic Area

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis, By Therapeutic Area, 2019-2023

- Current Market Size (US$ Mn) Analysis and Forecast, By Therapeutic Area, 2024-2032

- Oncology

- Neurology

- Cardiology

- Orthopedics

- Obstetrics & Gynecology

- Market Attractiveness Analysis: Therapeutic Area

- Global Clinical Trial Imaging Market Outlook: End User

- Introduction / Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis, By End User, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By End User, 2024-2032

- Contract Research Organizations (CROs)

- Pharmaceutical & Biotechnology Companies

- Academic and Government Research Institutes

- Key Highlights

- Global Clinical Trial Imaging Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Region, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Region, 2024-2032

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Clinical Trial Imaging Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Market, 2019-2023

- By Country

- By Product & Services

- By Modality

- By Therapeutic Area

- Current Market Size (US$ Mn) Analysis and Forecast, By Country, 2024-2032

- U.S.

- Canada

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Product & Services, 2024-2032

- Services

- Software

- Current Market Size (US$ Mn) Analysis and Forecast, By Modality, 2024-2032

- CT scan

- MRI

- X-Ray

- Current Market Size (US$ Mn) Analysis and Forecast, By Therapeutic Area , 2024-2032

- Oncology

- Neurology

- Cardiology

- Orthopedics

- Obstetrics & Gynecology

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By End User, 2024-2032

- Contract Research Organizations (CROs)

- Pharmaceutical & Biotechnology Companies

- Academic and Government Research Institutes

- Market Attractiveness Analysis

- Europe Clinical Trial Imaging Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Market, 2019-2023

- By Country

- By Product & Services

- By Modality

- By Therapeutic Area

- Current Market Size (US$ Mn) Analysis and Forecast, By Country, 2024-2032

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Türkiye

- Rest of Europe

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Product & Services, 2024-2032

- Services

- Software

- Current Market Size (US$ Mn) Analysis and Forecast, By Modality, 2024-2032

- CT scan

- MRI

- X-Ray

- Current Market Size (US$ Mn) Analysis and Forecast, By Therapeutic Area , 2024-2032

- Oncology

- Neurology

- Cardiology

- Orthopedics

- Obstetrics & Gynecology

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By End User, 2024-2032

- Contract Research Organizations (CROs)

- Pharmaceutical & Biotechnology Companies

- Academic and Government Research Institutes

- Market Attractiveness Analysis

- East Asia Clinical Trial Imaging Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Market, 2019-2023

- By Country

- By Product & Services

- By Modality

- By Therapeutic Area

- Current Market Size (US$ Mn) Analysis and Forecast, By Country, 2024-2032

- China

- Japan

- South Korea

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Product & Services, 2024-2032

- Services

- Software

- Current Market Size (US$ Mn) Analysis and Forecast, By Modality, 2024-2032

- CT scan

- MRI

- X-Ray

- Current Market Size (US$ Mn) Analysis and Forecast, By Therapeutic Area , 2024-2032

- Oncology

- Neurology

- Cardiology

- Orthopedics

- Obstetrics & Gynecology

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By End User, 2024-2032

- Contract Research Organizations (CROs)

- Pharmaceutical & Biotechnology Companies

- Academic and Government Research Institutes

- Market Attractiveness Analysis

- South Asia & Oceania Clinical Trial Imaging Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Market, 2019-2023

- By Country

- By Product & Services

- By Modality

- By Therapeutic Area

- Current Market Size (US$ Mn) Analysis and Forecast, By Country, 2024-2032

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Product & Services, 2024-2032

- Services

- Software

- Current Market Size (US$ Mn) Analysis and Forecast, By Modality, 2024-2032

- CT scan

- MRI

- X-Ray

- Current Market Size (US$ Mn) Analysis and Forecast, By Therapeutic Area , 2024-2032

- Oncology

- Neurology

- Cardiology

- Orthopedics

- Obstetrics & Gynecology

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By End User, 2024-2032

- Contract Research Organizations (CROs)

- Pharmaceutical & Biotechnology Companies

- Academic and Government Research Institutes

- Market Attractiveness Analysis

- Latin America Clinical Trial Imaging Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Market, 2019-2023

- By Country

- By Product & Services

- By Modality

- By Therapeutic Area

- Current Market Size (US$ Mn) Analysis and Forecast, By Country, 2024-2032

- Brazil

- Mexico

- Rest of Latin America

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Product & Services, 2024-2032

- Services

- Software

- Current Market Size (US$ Mn) Analysis and Forecast, By Modality, 2024-2032

- CT scan

- MRI

- X-Ray

- Current Market Size (US$ Mn) Analysis and Forecast, By Therapeutic Area , 2024-2032

- Oncology

- Neurology

- Cardiology

- Orthopedics

- Obstetrics & Gynecology

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By End User, 2024-2032

- Contract Research Organizations (CROs)

- Pharmaceutical & Biotechnology Companies

- Academic and Government Research Institutes

- Market Attractiveness Analysis

- Middle East & Africa Clinical Trial Imaging Market Outlook:

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Market, 2019-2023

- By Country

- By Product & Services

- By Modality

- By Therapeutic Area

- Current Market Size (US$ Mn) Analysis and Forecast, By Country, 2024-2032

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Product & Services, 2024-2032

- Services

- Software

- Current Market Size (US$ Mn) Analysis and Forecast, By Modality, 2024-2032

- CT scan

- MRI

- X-Ray

- Current Market Size (US$ Mn) Analysis and Forecast, By Therapeutic Area , 2024-2032

- Oncology

- Neurology

- Cardiology

- Orthopedics

- Obstetrics & Gynecology

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By End User, 2024-2032

- Contract Research Organizations (CROs)

- Pharmaceutical & Biotechnology Companies

- Academic and Government Research Institutes

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details – Overview, Financials, Strategy, Recent Developments)

- Ixico PLC

- Overview

- Segments and Product & Services Types

- Key Financials

- Market Developments

- Market Strategy

- Navitas Life Sciences

- Resonance Health

- Radiant Sage LLC

- Medpace

- WCG Clinical

- Icon PLC

- Voiant

- Clario

- Parexel International Corporation

- Anagram

- Calyx

- Invicro

- Ixico PLC

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations