Market Overview

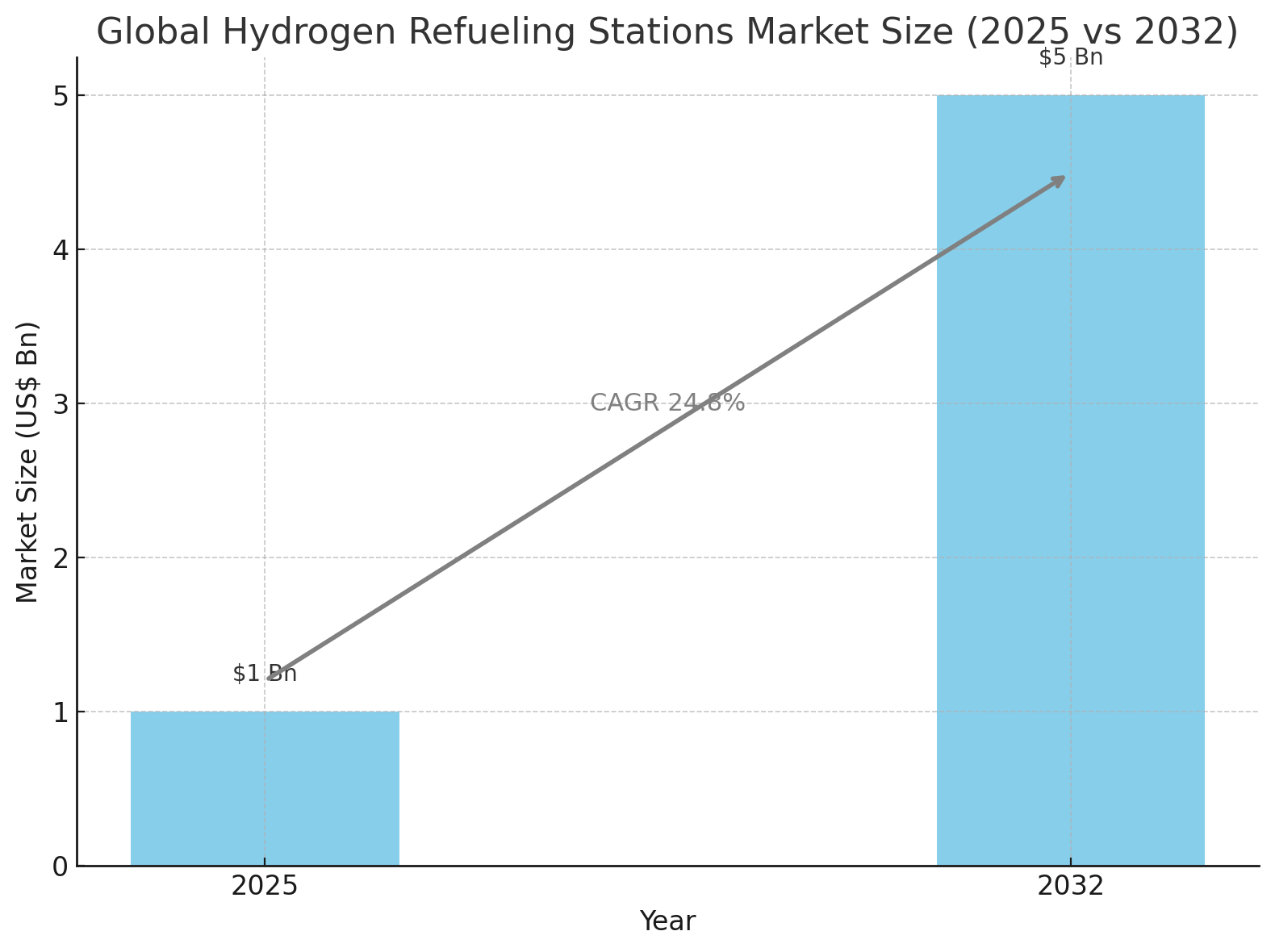

The global hydrogen refueling stations (HRS) market is poised for exponential growth, rising from an estimated US$ 1 billion in 2025 to US$ 5 billion by 2032. This represents a compound annual growth rate (CAGR) of 24.8% during the forecast period. The surge is largely attributed to the increasing adoption of hydrogen as a clean, alternative fuel and the rising demand for zero-emission vehicles across multiple transportation sectors.

Persistence Market Research notes that hydrogen-powered mobility, especially in public and heavy-duty transportation, is driving the demand for expanded HRS infrastructure. As hydrogen gains global traction, supportive policies and technological innovations are further bolstering market momentum.

Historical Performance and Government Backing

Between 2019 and 2024, the HRS market experienced a historical CAGR of 26.4%, fueled in part by policy-driven initiatives post-COVID-19. Governments in regions like North America and Europe accelerated investments in clean energy infrastructure. For instance, the Biden-Harris administration committed over US$ 600 million in grants to develop hydrogen refueling and EV charging stations across the U.S. Similarly, in 2023, Europe launched 37 new hydrogen refueling stations, reflecting its commitment to sustainable transportation.

Key Market Drivers

Accelerated Adoption of Hydrogen Vehicles

The market is seeing increased deployment of hydrogen fuel cell electric vehicles (FCEVs), particularly in heavy-duty sectors where electric vehicles (EVs) have limitations. Unlike battery EVs (BEVs), hydrogen trucks can travel significantly farther and refuel faster. A Clean Air Task Force study found that hydrogen-powered trucks can cover 2.5 times more distance per refueling compared to BEVs, with a 14-hour time savings in charging.

From 2019 to 2020, the global on-road fleet of FCEVs grew by 38%, reaching nearly 35,000 units. With forecasts predicting over 200,000 FCEVs by the end of the decade, demand for both stationary and mobile hydrogen refueling stations is set to accelerate.

Technological Innovations and Aviation Applications

Ongoing innovation in dispensing technologies and safety standards are making liquid hydrogen refueling stations (LHRS) more viable. Additionally, off-site HRS are becoming increasingly preferred due to lower spatial and capital requirements.

The aviation industry also presents a significant growth avenue. Companies like Airbus are investing heavily in hydrogen-powered aircraft. The company’s “ZEROe” program focuses on utilizing liquid hydrogen, which is 80% more space-efficient than its gaseous counterpart, to power long-haul flights with zero emissions. Burning hydrogen in jet engines results in water vapor, positioning hydrogen as an environmentally neutral fuel for aviation.

Market Challenges

Despite promising growth, the deployment of HRS infrastructure faces several challenges:

-

High Initial Investment: Establishing a refueling station involves high capital expenditure, especially when hydrogen is produced and delivered sustainably.

-

Low Renewable Hydrogen Production: As of now, only 1% of hydrogen globally is generated via renewable sources. Most hydrogen is still produced using fossil fuel-based methods, reducing environmental benefits.

-

Lack of Global Standardization: A key bottleneck is the absence of harmonized codes and standards for HRS and FCEVs across regions, hindering coordinated infrastructure development.

Strategic Opportunities

Mobile and Modular HRS Solutions

A promising trend is the rise of mobile hydrogen refueling stations, particularly suited for remote sites such as mines and large construction zones. These systems enable flexible fuel supply where permanent infrastructure is not yet established. According to PMR, the mobile HRS segment is forecast to grow at a CAGR of 30.1% from 2025 to 2032.

Off-site Hydrogen Production

Off-site hydrogen generation currently accounts for about 60% of HRS operations. This mode involves transporting hydrogen via pipeline or tanker from centralized facilities. Off-site systems are expected to maintain dominance due to lower setup costs and higher scalability, with a projected CAGR of 29.5% through 2032.

Regional Insights

Asia Pacific Leads Global Expansion

Asia Pacific holds approximately 50% of the global HRS market share, fueled by strong FCEV adoption in China, Japan, and South Korea. Major manufacturers like Toyota and Hyundai have pioneered hydrogen fuel cell technologies, leading to growing demand for supporting infrastructure.

In 2023, China’s Sinopec announced plans to build 1,000 hydrogen stations over the next five years, signaling a massive scale-up in national infrastructure.

Europe Continues Progressive Deployment

Europe is a global front-runner in sustainability, and this is reflected in its HRS development. Germany, France, and the Netherlands lead the region with a combined total of nearly 180 operational stations as of 2023. PMR forecasts a 26.4% CAGR for HRS installation in Europe through 2032.

Notable contributors include Air Liquide, H2 Mobility, TotalEnergies, and Colruyt Group, who are actively expanding infrastructure and collaborating with policymakers.

North America: Focused and High-Growth

While the U.S. has 74 operational HRS, over 70% are concentrated in California, owing to strong state-level policy support. Canada, on the other hand, is investing heavily to catch up. Its Zero Emission Vehicle Infrastructure Program (ZEVIP) aims to establish 30 HRS by 2029 with over CAD 680 million in funding.

Competitive Landscape

The hydrogen refueling station market remains relatively fragmented but dynamic. It is evolving rapidly through strategic alliances, partnerships, and government collaborations. Mergers and acquisitions are anticipated to streamline the industry and bring in greater coordination among global and regional players.

Leading companies include:

-

Air Liquide

-

Linde Group

-

Nel Hydrogen

-

Air Products

-

TotalEnergies

-

H2 Mobility

-

Sinopec

-

Japan H2 Mobility

-

McPhy Energy SA

-

SK Plug Hyverse

Collaborations between FCEV producers and HRS providers are critical for scaling infrastructure and market adoption. For example, in January 2025, Toyota Motors Europe partnered with HRS and ENGIE to enhance refueling capabilities for both light and heavy-duty vehicles. Similarly, Air Products has committed to building a network of commercial-scale HRS across California.

Future Outlook

With strong government backing, technological advancements, and increasing demand for clean energy, the HRS market is poised for substantial transformation. Key trends shaping the future include:

-

Rise of modular and mobile HRS units.

-

Expansion into aviation and marine fuel applications.

-

Greater investment in renewable hydrogen production.

-

Standardization efforts across countries to create a unified hydrogen ecosystem.

Companies that invest in strategic infrastructure, leverage public-private partnerships, and stay ahead of regulatory trends will be best positioned to capitalize on the next decade of growth in the hydrogen economy.

Table of Content

- Executive Summary

- Global Hydrogen Refuelling Stations (HRS) Market Snapshot 2024 and 2032

- Market Opportunity Assessment, 2024-2032, US$ Mn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global FCEV Sales by Country

- Global Renewable Hydrogen Projects by Country

- Global Green Hydrogen Market by Country

- Global Hydrogen Policies and Incentive Schemes by Country

- Forecast Factors – Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter’s Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2019 – 2032

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Global Hydrogen Refuelling Stations (HRS) Market Outlook:

- Key Highlights

- Global Hydrogen Refuelling Stations (HRS) Market Outlook: Fuel Type

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Fuel Type, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Fuel Type, 2024-2032

- Gas Hydrogen Refuelling Stations (GHRS)

- Liquid Hydrogen Refuelling Stations (LHRS)

- Market Attractiveness Analysis: Fuel Type

- Global Hydrogen Refuelling Stations (HRS) Market Outlook: Mode of Operations

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Mode of Operations, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Mode of Operations, 2024-2032

- On-site H2 production

- Off-site H2 Productions

- Market Attractiveness Analysis: Mode of Operations

- Global Hydrogen Refuelling Stations (HRS) Market Outlook: Station Type

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Station Type, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Station Type, 2024-2032

- Stationary

- Mobile

- Market Attractiveness Analysis: Station Type

- Global Hydrogen Refuelling Stations (HRS) Market Outlook: End User

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by End User, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End User, 2024-2032

- Automotive

- Marine

- Railway

- Aviation

- Market Attractiveness Analysis: End User

- Global Hydrogen Refuelling Stations (HRS) Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Region, 2019-2023

- Current Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Region, 2024-2032

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Hydrogen Refuelling Stations (HRS) Market Outlook:

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2024-2032

- U.S.

- Canada

- North America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Fuel Type, 2024-2032

- Gas Hydrogen Refuelling Stations (GHRS)

- Liquid Hydrogen Refuelling Stations (LHRS)

- North America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Mode of Operations, 2024-2032

- On-site H2 production

- Off-site H2 Productions

- North America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Station Type, 2024-2032

- Stationary

- Mobile

- North America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End User, 2024-2032

- Automotive

- Marine

- Railway

- Aviation

- Europe Hydrogen Refuelling Stations (HRS) Market Outlook:

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2024-2032

- Germany

- Italy

- France

- U.K.

- Spain

- Netherlands

- Switzerland

- Belgium

- Rest of Europe

- Europe Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Fuel Type, 2024-2032

- Gas Hydrogen Refuelling Stations (GHRS)

- Liquid Hydrogen Refuelling Stations (LHRS)

- Europe Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Mode of Operations, 2024-2032

- On-site H2 production

- Off-site H2 Productions

- Europe Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Station Type, 2024-2032

- Stationary

- Mobile

- Europe Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End User, 2024-2032

- Automotive

- Marine

- Railway

- Aviation

- East Asia Hydrogen Refuelling Stations (HRS) Market Outlook:

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2024-2032

- China

- Japan

- South Korea

- East Asia Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Fuel Type, 2024-2032

- Gas Hydrogen Refuelling Stations (GHRS)

- Liquid Hydrogen Refuelling Stations (LHRS)

- East Asia Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Mode of Operations, 2024-2032

- On-site H2 production

- Off-site H2 Productions

- East Asia Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Station Type, 2024-2032

- Stationary

- Mobile

- East Asia Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End User, 2024-2032

- Automotive

- Marine

- Railway

- Aviation

- South Asia & Oceania Hydrogen Refuelling Stations (HRS) Market Outlook:

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2024-2032

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Fuel Type, 2024-2032

- Gas Hydrogen Refuelling Stations (GHRS)

- Liquid Hydrogen Refuelling Stations (LHRS)

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Mode of Operations, 2024-2032

- On-site H2 production

- Off-site H2 Productions

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Station Type, 2024-2032

- Stationary

- Mobile

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End User, 2024-2032

- Automotive

- Marine

- Railway

- Aviation

- Latin America Hydrogen Refuelling Stations (HRS) Market Outlook:

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2024-2032

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Fuel Type, 2024-2032

- Gas Hydrogen Refuelling Stations (GHRS)

- Liquid Hydrogen Refuelling Stations (LHRS)

- Latin America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Mode of Operations, 2024-2032

- On-site H2 production

- Off-site H2 Productions

- Latin America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Station Type, 2024-2032

- Stationary

- Mobile

- Latin America Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End User, 2024-2032

- Automotive

- Marine

- Railway

- Aviation

- Middle East & Africa Hydrogen Refuelling Stations (HRS) Market Outlook:

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country, 2024-2032

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Fuel Type, 2024-2032

- Gas Hydrogen Refuelling Stations (GHRS)

- Liquid Hydrogen Refuelling Stations (LHRS)

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Mode of Operations, 2024-2032

- On-site H2 production

- Off-site H2 Productions

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Station Type, 2024-2032

- Stationary

- Mobile

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by End User, 2024-2032

- Automotive

- Marine

- Railway

- Aviation

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Air Liquide

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- Air Products and Chemicals

- Linde Group

- Nel Hydrogen

- H2 Mobility

- TotalEnergies

- Colruyt Group

- McPhy Energy SA

- Greenpoint

- SK Plug Hyverse

- ENEOS

- Japan H2 Mobility

- Sinopec

- Hynet

- Others

- Air Liquide

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations