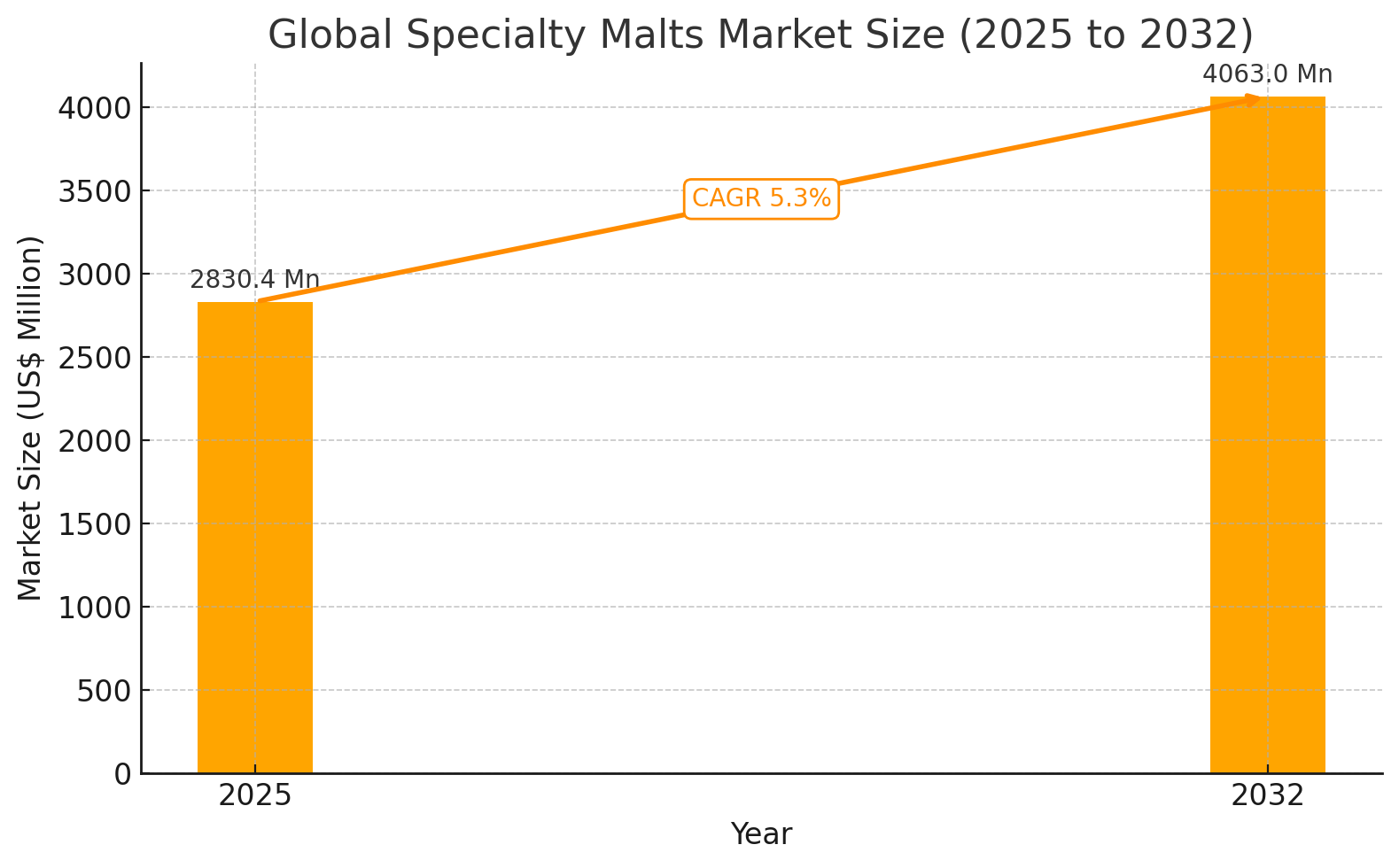

Global Specialty Malts Market Overview (2025–2032)

The global specialty malts market is expected to experience robust growth over the forecast period, with revenue projected to rise from USD 2,830.4 million in 2025 to USD 4,063.0 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.3%. This growth is attributed to increasing demand across the food and beverage industry, the rise in health-conscious consumer behavior, and the expanding popularity of craft brewing worldwide.

Between 2019 and 2024, the market grew at a steady CAGR of 4.6%, with roasted malt being a key contributor to this performance. The market value increased from approximately USD 1,734 million in 2019 to USD 2,705.9 million in 2024, supported by rising use in both brewing and non-alcoholic beverage applications. Western Europe leads in specialty malt consumption, followed by the Asia-Pacific region, with France and Belgium being significant exporters.

Specialty malts are derived from grains such as barley, wheat, corn, rice, and soybeans. These grains undergo a malting process where they are germinated, dried, and roasted to produce unique flavors, colors, and aromas. Specialty malts are valued for their multi-functionality and are used to enhance taste, appearance, and nutritional content in a wide range of food and beverage products.

A key growth driver is the increasing consumption of non-alcoholic health drinks, particularly in emerging markets like India. Specialty malt extracts are widely used in nutritional beverages due to their content of vitamins, fiber, proteins, and antioxidants. Indian brands such as Horlicks, Bournvita, Complan, and Amul have incorporated specialty malts as flavor enhancers, helping the country become the largest market for malt-based health drinks globally.

Alongside non-alcoholic beverages, the specialty malts market is benefiting from the expansion of craft breweries in developing nations such as China and India. With increasing disposable incomes and evolving consumer preferences, these markets are witnessing a shift towards premium and specialty beer products. China is set to surpass the U.S. as the world’s largest beer market, driven by brands such as Tsingtao, Snow, and Harbin. Similarly, India is seeing an annual growth rate of over 20% in craft beer consumption, creating opportunities for global malt suppliers to penetrate these fast-growing markets.

The versatility of specialty malts extends into the bakery and confectionery sectors, where they are used as natural colorants and flavoring agents. Specialty malts contribute to the texture, softness, and browning of baked goods such as bread, pizza bases, tortillas, and cookies. Products like malted barley syrup are gaining popularity as natural sweeteners and clean-label alternatives to refined sugar and artificial syrups. Additionally, malt flours are being used as dough conditioners to improve elasticity and proofing time in artisan-style baked goods.

Consumers’ growing interest in natural and organic ingredients is further boosting the appeal of specialty malts. As clean-label demand intensifies, food producers are adopting malt extracts for their natural processing advantages, minimal need for additives, and compliance with tightening food safety regulations.

From a regional perspective, the United Kingdom holds a leading share of 13.9% in the European specialty malt market, with roasted malt seeing increasing demand in craft beer and baking. The UK market was valued at USD 312 million in 2024, with projections indicating it will reach USD 504.2 million by 2032.

In East Asia, China dominates with an 80.1% share of the specialty malt market, thanks to its high processing capacity and export volume. China remains a central hub for malt-based brewing inputs across Asia and beyond, particularly for barley and roasted malt variants.

In terms of product form, dry specialty malt is the most widely used, particularly in sectors like dairy, frozen foods, bakery, and beverages. This form offers superior shelf life and ease of incorporation into various applications. Demand for dry malt is projected to grow at a CAGR of 7.1% through 2032, driven by its adaptability and stability in processed food formulations.

The beverage industry is the largest end-use segment, with brewing alone accounting for 89.6% of beverage segment sales globally. Specialty malts are essential for producing craft beers, lagers, ales, and stouts, delivering the unique color, flavor, and mouthfeel that define premium brews. The distilling industry and health drink manufacturers are also key buyers.

Hypermarkets and supermarkets remain dominant retail channels for specialty malt-based products, especially in regions with mature consumer packaged goods sectors. However, e-commerce is emerging as a growing distribution channel due to increased consumer interest in home-brewing kits and DIY baking and beverage products.

The specialty malts market is highly competitive and characterized by strategic expansions, product innovations, and acquisitions. Leading players are focused on enhancing production capacity, introducing novel malt types, and strengthening their global footprint.

For example, in 2019, Boortmalt acquired Cargill Malt, expanding its operations across 27 plants on five continents. In 2021, Mich. Weyermann GmbH & Co. KG invested in capacity expansion, while Palatia Malz GmbH introduced new diastatic barley and wheat malts to its product portfolio. Patagoniamalt secured kosher certification in 2020, underscoring the industry’s move toward quality and certification standards.

Major companies in this market include Malteurop, Weyermann, Boortmalt, Canada Malting, Rahr, IREKS, Bestmalz, Muntons, Crisp, Simpsons, Viking, Proximity, and Soufflet, among others. These players are actively involved in R&D, sustainability initiatives, and the development of malts tailored to evolving consumer demands across both food and beverage sectors.

As consumers seek more natural, flavorful, and nutritious products, and as the brewing and bakery industries diversify their product offerings, the specialty malts market is well-positioned to sustain long-term growth. Clean label trends, dietary awareness, and functional benefits will continue to shape the innovation pipeline in this evolving and increasingly global industry.

Specialty Malts Industry Research by Category

By Grade:

- Food Grade

- Brewing Grade Organic

By Type:

- Caramelized Malt

- Roasted Malt

By Source:

- Barley

- Wheat

- Ryes

- Oat

- Others

By End Use:

- Food

- Dairy & Frozen Food products

- Bakery & Confectionery

- Others

- Beverages

- Alcoholic

- Brewing

- Distilling

- Non-Alcoholic

- Health Drinks

- Energy Drinks

- Others

- Alcoholic

By Extract Type:

- Dry

- Liquid

- Malt Flours

By Region:

- North America

- Latin America

- Europe

- South Asia & Pacific

- East Asia

- Middle East & Africa

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Technology Roadmap

1.5. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

4.3. Product Differentiation and Brand’s Strategy Analysis

5. Global Specialty Malts Market Demand Analysis 2019-2023 and Forecast, 2024-2032

5.1. Historical Market Volume (Tons) Analysis, 2019-2023

5.2. Current and Future Market Volume (Tons) Projections, 2024-2032

5.3. Y-o-Y Growth Trend Analysis

6. Global Specialty Malts Market – Pricing Analysis

6.1. Regional Pricing Trend Analysis

6.2. Global Average Pricing Analysis Benchmark

7. Global Specialty Malts Market Demand (in Value or Size in US$ Mn) Analysis 2019-2023 and Forecast, 2024-2032

7.1. Historical Market Value (US$ Mn) Analysis, 2019-2023

7.2. Current and Future Market Value (US$ Mn) Projections, 2024-2032

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Macro-Economic Factors

8.1.1. Global GDP Growth Outlook

8.1.2. Global Food Industry Overview

8.1.3. Global GDP and Infrastructure Investment

8.1.4. International Trade

8.1.5. Global Industry Outlook

8.2. Forecast Factors – Relevance & Impact

8.2.1. Top Companies Historical Growth

8.2.2. GDP Growth forecast

8.2.3. Manufacturing Industry forecast

8.2.4. Business Climate

8.3. Value Chain

8.3.1. Raw Material Suppliers

8.3.2. Product Manufacturers

8.3.3. End Users

8.4. Global Food Industry Outlook

8.5. Market Dynamics

8.5.1. Drivers

8.5.2. Restraints

8.5.3. Opportunity Analysis

8.6. Global Supply Demand Analysis

9. Global Specialty Malts Market Outlook, 2019 – 2032, By Grade

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Mn) and Volume Analysis By Grade, 2019-2023

9.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Grade, 2024-2032

9.3.1. Food Grade

9.3.2. Brewing Grade Organic

9.4. Market Attractiveness Analysis By Grade

10. Global Specialty Malts Market Outlook, 2019 – 2032, by Type

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume Analysis By Type, 2019-2023

10.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Type, 2024-2032

10.3.1. Caramelized Malt

10.3.2. Roasted Malt

10.4. Market Attractiveness Analysis By Type

11. Global Specialty Malts Market Outlook, 2019 – 2032, by Source

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) and Volume Analysis By Source, 2019-2023

11.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Source, 2024-2032

11.3.1. Barley

11.3.2. Wheat

11.3.3. Ryes

11.3.4. Oat

11.3.5. Others

11.4. Market Attractiveness Analysis By Source

12. Global Specialty Malts Market Outlook, 2019 – 2032, By End Use

12.1. Introduction / Key Findings

12.2. Historical Market Size (US$ Mn) and Volume Analysis By End Use, 2019-2023

12.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By End Use, 2024-2032

12.3.1. Food

12.3.1.1. Dairy & Frozen Food products

12.3.1.2. Bakery & Confectionery

12.3.1.3. Others

12.3.2. Beverages

12.3.3. Alcoholic

12.3.3.1. Brewing

12.3.3.2. Distilling

12.3.4. Non-Alcoholic

12.3.4.1. Health Drinks

12.3.4.2. Energy Drinks

12.3.4.3. Others

12.4. Market Attractiveness Analysis By End Use

13. Global Specialty Malts Market Outlook, 2019 – 2032, by Extract Type

13.1. Introduction / Key Findings

13.2. Historical Market Size (US$ Mn) and Volume Analysis By Extract Type, 2019-2023

13.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Extract Type, 2024-2032

13.3.1. Dry

13.3.2. Liquid

13.3.3. Malt Flours

13.4. Market Attractiveness Analysis By Extract Type

14. Global Specialty Malts Market Outlook, 2019 – 2032, by Region

14.1. Introduction

14.2. Historical Market Size (US$ Mn) and Volume Analysis By Region, 2019-2023

14.3. Current Market Size (US$ Mn) and Volume Analysis and Forecast By Region, 2024-2032

14.3.1. North America

14.3.2. Latin America

14.3.3. Europe

14.3.4. East Asia

14.3.5. South Asia and Pacific

14.3.6. Middle East and Africa (MEA)

14.4. Market Attractiveness Analysis By Region

15. North America Specialty Malts Market Outlook, 2019 – 2032

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

15.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

15.4.1. By Country

15.4.1.1. U.S.

15.4.1.2. Canada

15.4.2. By Grade

15.4.3. By Type

15.4.4. By Source

15.4.5. By End Use

15.4.6. By Extract Type

15.5. Market Attractiveness Analysis

15.5.1. By Country

15.5.2. By Grade

15.5.3. By Type

15.5.4. By Source

15.5.5. By End Use

15.5.6. By Extract Type

15.6. Market Trends

15.7. Key Market Participants – Intensity Mapping

15.8. Drivers and Restraints – Impact Analysis

16. Latin America Specialty Malts Market Outlook, 2019 – 2032

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

16.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

16.4.1. By Country

16.4.1.1. Brazil

16.4.1.2. Mexico

16.4.1.3. Argentina

16.4.1.4. Rest of Latin America

16.4.2. By Grade

16.4.3. By Type

16.4.4. By Source

16.4.5. By End Use

16.4.6. By Extract Type

16.5. Market Attractiveness Analysis

16.5.1. By Country

16.5.2. By Grade

16.5.3. By Type

16.5.4. By Source

16.5.5. By End Use

16.5.6. By Extract Type

16.6. Market Trends

16.7. Key Market Participants – Intensity Mapping

16.8. Drivers and Restraints – Impact Analysis

17. Europe Specialty Malts Market Outlook, 2019 – 2032

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

17.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

17.4.1. By Country

17.4.1.1. Germany

17.4.1.2. Italy

17.4.1.3. France

17.4.1.4. U.K.

17.4.1.5. Spain

17.4.1.6. BENELUX

17.4.1.7. Nordic

17.4.1.8. Russia

17.4.1.9. Poland

17.4.1.10. Rest of Europe

17.4.2. By Grade

17.4.3. By Type

17.4.4. By Source

17.4.5. By End Use

17.4.6. By Extract Type

17.5. Market Attractiveness Analysis

17.5.1. By Country

17.5.2. By Grade

17.5.3. By Type

17.5.4. By Source

17.5.5. By End Use

17.5.6. By Extract Type

17.6. Market Trends

17.7. Key Market Participants – Intensity Mapping

17.8. Drivers and Restraints – Impact Analysis

18. South Asia and Pacific Specialty Malts Market Outlook, 2019 – 2032

18.1. Introduction

18.2. Pricing Analysis

18.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

18.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

18.4.1. By Country

18.4.1.1. India

18.4.1.2. ASEAN

18.4.1.3. Oceania (Australia & New Zealand)

18.4.1.4. Rest of South Asia & Pacific

18.4.2. By Grade

18.4.3. By Type

18.4.4. By Source

18.4.5. By End Use

18.4.6. By Extract Type

18.5. Market Attractiveness Analysis

18.5.1. By Country

18.5.2. By Grade

18.5.3. By Type

18.5.4. By Source

18.5.5. By End Use

18.5.6. By Extract Type

18.6. Market Trends

18.7. Key Market Participants – Intensity Mapping

18.8. Drivers and Restraints – Impact Analysis

19. East Asia Specialty Malts Market Outlook, 2019 – 2032

19.1. Introduction

19.2. Pricing Analysis

19.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

19.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

19.4.1. By Country

19.4.1.1. China

19.4.1.2. Japan

19.4.1.3. South Korea

19.4.2. By Grade

19.4.3. By Type

19.4.4. By Source

19.4.5. By End Use

19.4.6. By Extract Type

19.5. Market Attractiveness Analysis

19.5.1. By Country

19.5.2. By Grade

19.5.3. By Type

19.5.4. By Source

19.5.5. By End Use

19.5.6. By Extract Type

19.6. Market Trends

19.7. Key Market Participants – Intensity Mapping

19.8. Drivers and Restraints – Impact Analysis

20. Middle East and Africa Specialty Malts Market Outlook, 2019 – 2032

20.1. Introduction

20.2. Pricing Analysis

20.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

20.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

20.4.1. By Country

20.4.1.1. GCC Countries

20.4.1.2. Turkey

20.4.1.3. Northern Africa

20.4.1.4. South Africa

20.4.1.5. Rest of Middle East and Africa

20.4.2. By Grade

20.4.3. By Type

20.4.4. By Source

20.4.5. By End Use

20.4.6. By Extract Type

20.5. Market Attractiveness Analysis

20.5.1. By Country

20.5.2. By Grade

20.5.3. By Type

20.5.4. By Source

20.5.5. By End Use

20.5.6. By Extract Type

20.6. Market Trends

20.7. Key Market Participants – Intensity Mapping

20.8. Drivers and Restraints – Impact Analysis

21. Country Wise Specialty Malts Market Analysis, 2022

21.1. Introduction

21.1.1. Market Value Proportion Analysis, By Key Countries

21.1.2. Global Vs. Country Growth Comparison

21.2. U.S. Specialty Malts Market Analysis

21.2.1. By Grade

21.2.2. By Type

21.2.3. By Source

21.2.4. By End Use

21.2.5. By Extract Type

21.3. Canada Specialty Malts Market Analysis

21.3.1. By Grade

21.3.2. By Type

21.3.3. By Source

21.3.4. By End Use

21.3.5. By Extract Type

21.4. Mexico Specialty Malts Market Analysis

21.4.1. By Grade

21.4.2. By Type

21.4.3. By Source

21.4.4. By End Use

21.4.5. By Extract Type

21.5. Brazil Specialty Malts Market Analysis

21.5.1. By Grade

21.5.2. By Type

21.5.3. By Source

21.5.4. By End Use

21.5.5. By Extract Type

21.6. Argentina Specialty Malts Market Analysis

21.6.1. By Grade

21.6.2. By Type

21.6.3. By Source

21.6.4. By End Use

21.6.5. By Extract Type

21.7. Germany Specialty Malts Market Analysis

21.7.1. By Grade

21.7.2. By Type

21.7.3. By Source

21.7.4. By End Use

21.7.5. By Extract Type

21.8. Italy Specialty Malts Market Analysis

21.8.1. By Grade

21.8.2. By Type

21.8.3. By Source

21.8.4. By End Use

21.8.5. By Extract Type

21.9. France Specialty Malts Market Analysis

21.9.1. By Grade

21.9.2. By Type

21.9.3. By Source

21.9.4. By End Use

21.9.5. By Extract Type

21.10. U.K. Specialty Malts Market Analysis

21.10.1. By Grade

21.10.2. By Type

21.10.3. By Source

21.10.4. By End Use

21.10.5. By Extract Type

21.11. Spain Specialty Malts Market Analysis

21.11.1. By Grade

21.11.2. By Type

21.11.3. By Source

21.11.4. By End Use

21.11.5. By Extract Type

21.12. Russia Specialty Malts Market Analysis

21.12.1. By Grade

21.12.2. By Type

21.12.3. By Source

21.12.4. By End Use

21.12.5. By Extract Type

21.13. Poland Specialty Malts Market Analysis

21.13.1. By Grade

21.13.2. By Type

21.13.3. By Source

21.13.4. By End Use

21.13.5. By Extract Type

21.14. China Specialty Malts Market Analysis

21.14.1. By Grade

21.14.2. By Type

21.14.3. By Source

21.14.4. By End Use

21.14.5. By Extract Type

21.15. Japan Specialty Malts Market Analysis

21.15.1. By Grade

21.15.2. By Type

21.15.3. By Source

21.15.4. By End Use

21.15.5. By Extract Type

21.16. S. Korea Specialty Malts Market Analysis

21.16.1. By Grade

21.16.2. By Type

21.16.3. By Source

21.16.4. By End Use

21.16.5. By Extract Type

21.17. India Specialty Malts Market Analysis

21.17.1. By Grade

21.17.2. By Type

21.17.3. By Source

21.17.4. By End Use

21.17.5. By Extract Type

21.18. Turkey Specialty Malts Market Analysis

21.18.1. By Grade

21.18.2. By Type

21.18.3. By Source

21.18.4. By End Use

21.18.5. By Extract Type

21.19. South Africa Specialty Malts Market Analysis

21.19.1. By Grade

21.19.2. By Type

21.19.3. By Source

21.19.4. By End Use

21.19.5. By Extract Type

22. Market Structure Analysis

22.1. Market Analysis by Tier of Companies (Specialty Malts)

22.2. Market Share Analysis of Top Players

22.3. Market Presence Analysis

23. Competition Analysis

23.1. Competition Dashboard

23.2. Competition Benchmarking

23.3. Competition Deep Dive

23.3.1. Great Western

23.3.1.1. Overview

23.3.1.2. Product Portfolio

23.3.1.3. Profitability by Market Segments (Product/Channel/Region)

23.3.1.4. Sales Footprint

23.3.1.5. Strategy Overview

23.3.2. Malteurop

23.3.2.1. Overview

23.3.2.2. Product Portfolio

23.3.2.3. Profitability by Market Segments (Product/Channel/Region)

23.3.2.4. Sales Footprint

23.3.2.5. Strategy Overview

23.3.3. Weyermann

23.3.3.1. Overview

23.3.3.2. Product Portfolio

23.3.3.3. Profitability by Market Segments (Product/Channel/Region)

23.3.3.4. Sales Footprint

23.3.3.5. Strategy Overview

23.3.4. Canada Malting

23.3.4.1. Overview

23.3.4.2. Product Portfolio

23.3.4.3. Profitability by Market Segments (Product/Channel/Region)

23.3.4.4. Sales Footprint

23.3.4.5. Strategy Overview

23.3.5. Rahr

23.3.5.1. Overview

23.3.5.2. Product Portfolio

23.3.5.3. Profitability by Market Segments (Product/Channel/Region)

23.3.5.4. Sales Footprint

23.3.5.5. Strategy Overview

23.3.6. IREKS

23.3.6.1. Overview

23.3.6.2. Product Portfolio

23.3.6.3. Profitability by Market Segments (Product/Channel/Region)

23.3.6.4. Sales Footprint

23.3.6.5. Strategy Overview

23.3.7. Bestmalz

23.3.7.1. Overview

23.3.7.2. Product Portfolio

23.3.7.3. Profitability by Market Segments (Product/Channel/Region)

23.3.7.4. Sales Footprint

23.3.7.5. Strategy Overview

23.3.8. Prairie Malt / Boortmalt

23.3.8.1. Overview

23.3.8.2. Product Portfolio

23.3.8.3. Profitability by Market Segments (Product/Channel/Region)

23.3.8.4. Sales Footprint

23.3.8.5. Strategy Overview

23.3.9. Munton’s

23.3.9.1. Overview

23.3.9.2. Product Portfolio

23.3.9.3. Profitability by Market Segments (Product/Channel/Region)

23.3.9.4. Sales Footprint

23.3.9.5. Strategy Overview

23.3.10. Crisp

23.3.10.1. Overview

23.3.10.2. Product Portfolio

23.3.10.3. Profitability by Market Segments (Product/Channel/Region)

23.3.10.4. Sales Footprint

23.3.10.5. Strategy Overview

23.3.11. Baird’s

23.3.11.1. Overview

23.3.11.2. Product Portfolio

23.3.11.3. Profitability by Market Segments (Product/Channel/Region)

23.3.11.4. Sales Footprint

23.3.11.5. Strategy Overview

23.3.12. Simpson’s

23.3.12.1. Overview

23.3.12.2. Product Portfolio

23.3.12.3. Profitability by Market Segments (Product/Channel/Region)

23.3.12.4. Sales Footprint

23.3.12.5. Strategy Overview

23.3.13. Viking

23.3.13.1. Overview

23.3.13.2. Product Portfolio

23.3.13.3. Profitability by Market Segments (Product/Channel/Region)

23.3.13.4. Sales Footprint

23.3.13.5. Strategy Overview

23.3.14. Patagonia

23.3.14.1. Overview

23.3.14.2. Product Portfolio

23.3.14.3. Profitability by Market Segments (Product/Channel/Region)

23.3.14.4. Sales Footprint

23.3.14.5. Strategy Overview

23.3.15. Proximity

23.3.15.1. Overview

23.3.15.2. Product Portfolio

23.3.15.3. Profitability by Market Segments (Product/Channel/Region)

23.3.15.4. Sales Footprint

23.3.15.5. Strategy Overview

23.3.16. Epiphany

23.3.16.1. Overview

23.3.16.2. Product Portfolio

23.3.16.3. Profitability by Market Segments (Product/Channel/Region)

23.3.16.4. Sales Footprint

23.3.16.5. Strategy Overview

23.3.17. Soufflet

23.3.17.1. Overview

23.3.17.2. Product Portfolio

23.3.17.3. Profitability by Market Segments (Product/Channel/Region)

23.3.17.4. Sales Footprint

23.3.17.5. Strategy Overview

23.3.18. AxerealOthers (Available on request)

23.3.18.1. Overview

23.3.18.2. Product Portfolio

23.3.18.3. Profitability by Market Segments (Product/Channel/Region)

23.3.18.4. Sales Footprint

23.3.18.5. Strategy Overview

Note: The list of companies above is tentative and it is subjected to change based on research process and/or customization requirements.

24. Assumptions and Acronyms Used

25. Research Methodology