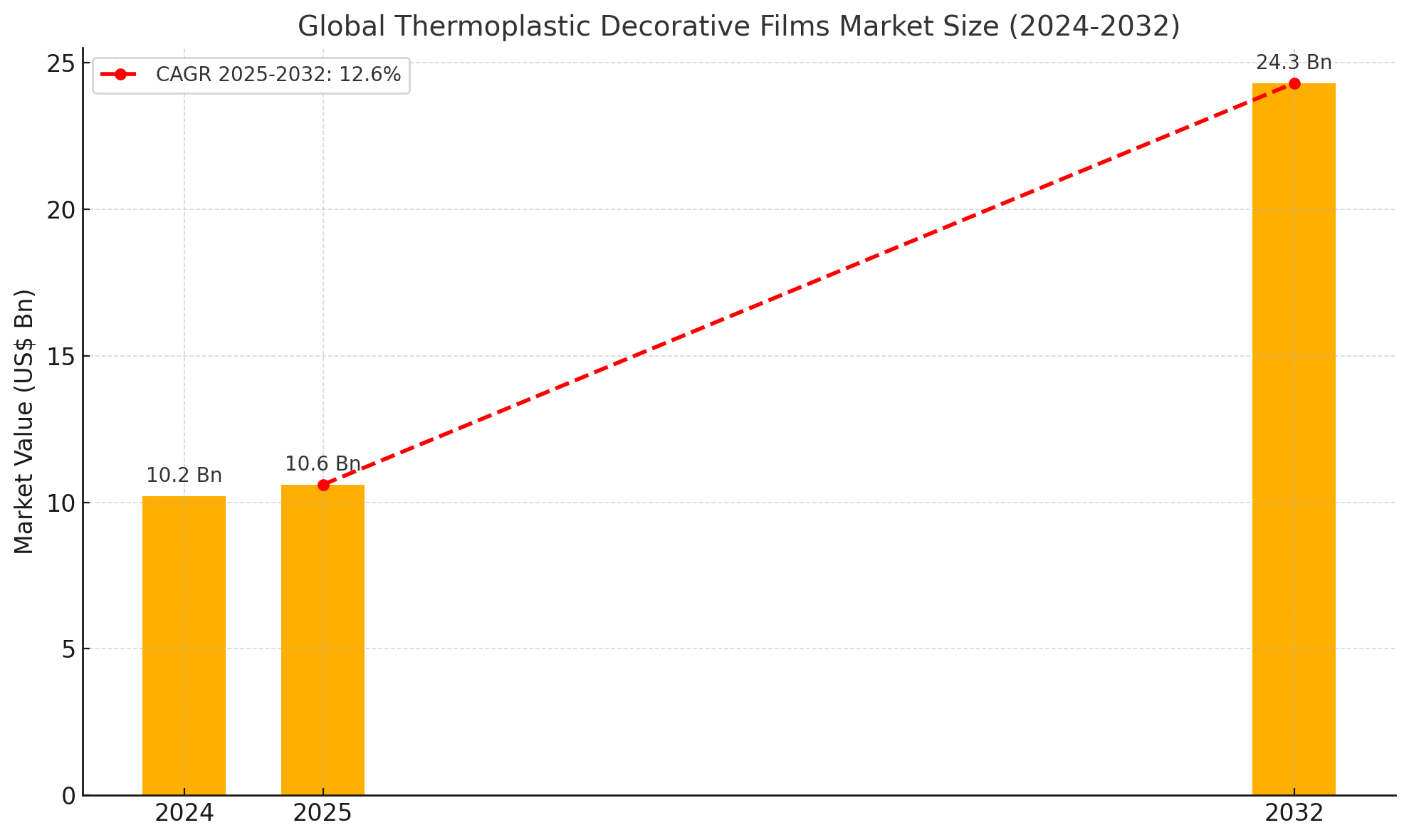

The global thermoplastic decorative films market is projected to grow significantly, reaching approximately USD 24.3 billion by 2032 from USD 10.6 billion in 2025. This expansion represents a compound annual growth rate (CAGR) of 12.6%. The growth is primarily driven by the increasing pace of urbanization, particularly in emerging economies such as China, India, Pakistan, Bangladesh, the Philippines, and Vietnam, which are expected to contribute substantially to the global urban population over the next three decades.

Thermoplastic decorative films are widely used in construction, automotive, and furniture applications. In the construction industry, these films are applied to various surfaces in residential, commercial, and institutional buildings, including walls, ceilings, furniture, doors, and windows. Their thermal insulation properties help regulate indoor temperature and reduce energy consumption, making them attractive for sustainable building solutions. As urbanization increases, so does the demand for energy-efficient and aesthetically appealing construction materials, contributing to the expansion of this market.

The automotive sector also plays a crucial role in the growing demand for thermoplastic decorative films. These films are used in interior and exterior applications such as dashboards, audio systems, airbag panels, windows, and body trims. The rising production of vehicles in developing countries, coupled with increasing consumer demand for durable and visually appealing interiors, is further accelerating the use of these materials. Automotive manufacturers are increasingly adopting high-temperature and chemically resistant films to improve the durability and performance of vehicle components.

Despite the promising growth prospects, the market faces several challenges. One of the primary concerns is the competition from alternative materials such as acrylonitrile-styrene acrylate, polyetherimide, and other high-performance polymer sheets, which offer similar benefits at potentially lower costs. In addition, regulatory restrictions on non-biodegradable materials and chemically treated products pose compliance hurdles, especially in regions with strict environmental policies. These factors may hinder the widespread adoption of thermoplastic decorative films unless manufacturers develop cost-effective and eco-friendly solutions.

To address these challenges, manufacturers are exploring new production techniques and sustainable materials. One emerging trend is the use of digital printing technologies, which offer shorter production cycles and reduced environmental impact. These technologies also allow for greater customization, enabling customers to print personalized images, logos, or artwork on decorative films for use in homes and offices. This customization potential is expanding the application scope of thermoplastic decorative films in both residential and commercial markets.

Government policies promoting energy efficiency in buildings are opening new opportunities for manufacturers. Decorative films applied to doors and windows can significantly reduce heating and cooling demands, making them a valuable component of green building initiatives. Additionally, rising disposable incomes and changing lifestyle preferences are driving demand for personalized furniture and smart interior designs. This trend is particularly pronounced in urban areas, where consumers are willing to invest in high-quality, space-saving, and visually appealing home furnishings.

Regionally, China dominates the market, holding over 79% of the East Asian market share. The country’s large population and limited living space have led to a surge in demand for compact, multifunctional furniture solutions, many of which incorporate thermoplastic decorative films. China’s commitment to sustainable energy and environmental conservation further supports the use of energy-efficient materials in the construction and furniture industries.

The United States is also a major market, expected to see a year-over-year growth rate of 5.9% in 2025. The growing number of commercial buildings and the expanding construction industry are creating strong demand for decorative films in furniture, doors, and window applications. However, manufacturers in the U.S. face strict regulations related to environmental compliance, which has historically presented challenges but also pushed innovation and the development of eco-friendly alternatives.

From a material perspective, polypropylene is emerging as one of the most popular thermoplastic decorative film materials, expected to grow at a CAGR of over 6% during the forecast period. Its advantages include durability, rigidity, cost-effectiveness, and aesthetic appeal. It is increasingly used in furniture and automotive applications due to its high tensile strength and clarity.

Among the application segments, the furniture industry holds the largest share, accounting for approximately 43.4% of the market. Thermoplastic decorative films are used to enhance the appearance and durability of various furniture items such as cabinets, doors, drawers, and tables. They offer protection against moisture, wear, and scratches, making them ideal for modern furniture designs that require both functionality and style.

The competitive landscape of the thermoplastic decorative films market is marked by the presence of several global and regional players. Leading companies are investing in capacity expansion, product innovation, and strategic partnerships to strengthen their market positions. Key strategies include acquisitions, collaborations with furniture and automotive manufacturers, and the development of environmentally sustainable products.

Notable industry developments include the acquisition of RFID technology assets by major manufacturers, expansion of production capacities in North America for heat shrink labels, and initiatives to diversify product portfolios through investments in research and development. These strategic moves aim to capture new market segments and respond to evolving consumer preferences.

In conclusion, the thermoplastic decorative films market is set for robust growth, driven by trends in urbanization, construction, automotive production, and consumer demand for customization and sustainability. While challenges such as regulatory constraints and competition from alternative materials persist, the market is well-positioned to capitalize on opportunities presented by technological advancements, government initiatives, and shifting consumer lifestyles. As industries and consumers alike prioritize energy efficiency, aesthetic appeal, and environmental responsibility, thermoplastic decorative films are likely to become an integral part of global manufacturing and design trends.

Market Segmentation

By Material Type:

- Vinyl and Polyvinyl Chloride

- PET

- Polypropylene

- TPU

- TPO

- TPE

By Application:

- Furniture

- Doors & Windows

- Automotive Interior and Exterior

By End Use:

- Residential

- Commercial

- Transportation

- Institutional

By Function:

- 2D Lamination

- 3D Lamination

- Self-Adhesive Films

By Installation:

- New

- Re-decoration

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Technology Roadmap

1.5. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product innovation & Diversification

4.3. Marketing and Brand management

4.4. Supply Chain Management

5. Global Market Demand Analysis 2019-2023 and Forecast, 2024-2032

5.1. Historical Market Volume (Mn Sq. Meters) Analysis, 2019-2023

5.2. Current and Future Market Volume (Mn Sq. Meters) Projections, 2024-2032

5.3. Y-o-Y Growth Trend Analysis

6. Global Market – Pricing Analysis

6.1. Pricing Analysis By Material Type

6.2. Pricing Break-up

6.3. Global Average Pricing Analysis Benchmark

7. Global Demand (in Value or Size in US$ Mn) Analysis 2019-2023 and Forecast, 2024-2032

7.1. Historical Market Value (US$ Mn) Analysis, 2019-2023

7.2. Current and Future Market Value (US$ Mn) Projections, 2024-2032

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Macro-Economic Factors

8.1.1. Global GDP Growth Outlook

8.1.2. Global Population Overview

8.1.3. Global Urbanization Outlook

8.1.4. Global Construction Industry Overview

8.1.5. Global Automotive Industry Outlook

8.1.6. Global Chemical Industry Overview

8.1.7. Global Furniture Production Overview

8.1.8. Other Key Macroeconomic Factors

8.2. Forecast Factors – Relevance & Impact

8.2.1. Historic Growth Rate of Companies

8.2.2. Global Population Outlook

8.2.3. Global Urbanization Growth Outlook

8.2.4. Regulatory Impact Outlook

8.2.5. Key Technology Developments

8.2.6. Other Key Forecast Factors

8.3. Value Chain Analysis

8.4. List of Key Market Participants

8.5. Supply Demand Overview

8.6. Impact of COVID – 19 Crisis

8.6.1. Introduction

8.6.2. World Economy / Cluster Projections

8.6.3. Potential of Impact by Taxonomy

8.6.4. Recovery Scenario (Short, Mid and Long term)

8.6.5. Key Strategies

8.7. Market Dynamics

8.7.1. Drivers

8.7.2. Restraints

8.7.3. Opportunity Analysis

8.8. Comparison of Thermoplastic Film Materials and Application

8.9. Comparison of Thermoplastic Film Materials and Physical Properties

9. Global Market Outlook, 2019 – 2032 , By Material Type

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Mn) and Volume Analysis By Material Type, 2019-2023

9.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Material Type, 2024-2032

9.3.1. Vinyl and Polyvinyl Chloride

9.3.2. PET

9.3.3. Polypropylene

9.3.4. TPU

9.3.5. TPO

9.3.6. TPE

9.4. Market Attractiveness Analysis By Material Type

10. Global Market Outlook, 2019 – 2032 , By Application

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume Analysis By Application, 2019-2023

10.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Application, 2024-2032

10.3.1. Furniture

10.3.1.1. Furniture Fronts

10.3.1.2. Cabinets & Frames

10.3.1.3. Tables

10.3.1.4. Ceiling Applications

10.3.1.5. Decorative Self Adhesive Applications

10.3.2. Doors and Windows

10.3.3. Automotive Interior and Exterior

10.4. Market Attractiveness Analysis By Application

11. Global Market Outlook, 2019 – 2032 , By End Use

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) and Volume Analysis By End Use, 2019-2023

11.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By End Use, 2024-2032

11.3.1. Residential

11.3.2. Commercial

11.3.2.1. Indoor

11.3.2.2. Outdoor

11.3.3. Transportation

11.3.4. Institutional

11.4. Analysis By End Use

12. Global Market Outlook, 2019 – 2032 , By Function

12.1. Introduction / Key Findings

12.2. Historical Market Size (US$ Mn) and Volume Analysis By Function, 2019-2023

12.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Function, 2024-2032

12.3.1. 2D Lamination

12.3.2. 3D Lamination

12.3.3. Self-Adhesive Films

12.4. Analysis By Function

13. Global Market Outlook, 2019 – 2032 , By Installation

13.1. Introduction / Key Findings

13.2. Historical Market Size (US$ Mn) and Volume Analysis By Installation, 2019-2023

13.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Installation, 2024-2032

13.3.1. 2D Lamination

13.3.2. 3D Lamination

13.3.3. Self-Adhesive Films

13.4. Analysis By Installation

14. Global Market Outlook, 2019 – 2032 , by Region

14.1. Introduction

14.2. Historical Market Size (US$ Mn) and Volume Analysis By Region, 2019-2023

14.3. Current Market Size (US$ Mn) and Volume Analysis and Forecast By Region, 2024-2032

14.3.1. North America

14.3.2. Latin America

14.3.3. Europe

14.3.4. East Asia

14.3.5. South Asia & Pacific

14.3.6. Middle East & Africa

14.4. Market Attractiveness Analysis By Region

15. North America Market Outlook, 2019 – 2032

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

15.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

15.4.1. By Material Type

15.4.2. By Application

15.4.3. By End Use

15.4.4. By Function

15.4.5. By Installation

15.4.6. By Country

15.4.6.1. U.S.

15.4.6.2. Canada

15.5. Market Attractiveness Analysis

15.5.1. By Material Type

15.5.2. By Application

15.5.3. By End Use

15.5.4. By Function

15.5.5. By Installation

15.5.6. By Country

15.6. Market Trends

15.7. Key Market Participants – Intensity Mapping

16. Latin America Market Outlook, 2019 – 2032

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

16.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

16.4.1. By Material Type

16.4.2. By Application

16.4.3. By End Use

16.4.4. By Function

16.4.5. By Installation

16.4.6. By Country

16.4.6.1. Brazil

16.4.6.2. Mexico

16.4.6.3. Rest of Latin America

16.5. Market Attractiveness Analysis

16.5.1. By Material Type

16.5.2. By Application

16.5.3. By End Use

16.5.4. By Function

16.5.5. By Installation

16.5.6. By Country

16.6. Market Trends

16.7. Key Market Participants – Intensity Mapping

17. Europe Market Outlook, 2019 – 2032

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

17.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

17.4.1. By Material Type

17.4.2. By Application

17.4.3. By End Use

17.4.4. By Function

17.4.5. By Installation

17.4.6. By Country

17.4.6.1. Germany

17.4.6.2. Italy

17.4.6.3. France

17.4.6.4. U.K.

17.4.6.5. Spain

17.4.6.6. BENELUX

17.4.6.7. Russia

17.4.6.8. Rest of Europe

17.5. Market Attractiveness Analysis

17.5.1. By Material Type

17.5.2. By Application

17.5.3. By End Use

17.5.4. By Function

17.5.5. By Installation

17.5.6. By Country

17.6. Market Trends

17.7. Key Market Participants – Intensity Mapping

18. East Asia Market Outlook, 2019 – 2032

18.1. Introduction

18.2. Pricing Analysis

18.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

18.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

18.4.1. By Material Type

18.4.2. By Application

18.4.3. By End Use

18.4.4. By Function

18.4.5. By Installation

18.4.6. By Country

18.4.6.1. China

18.4.6.2. Japan

18.4.6.3. South Korea

18.5. Market Attractiveness Analysis

18.5.1. By Material Type

18.5.2. By Application

18.5.3. By End Use

18.5.4. By Function

18.5.5. By Installation

18.5.6. By Country

18.6. Market Trends

18.7. Key Market Participants – Intensity Mapping

19. South Asia & Pacific Market Outlook, 2019 – 2032

19.1. Introduction

19.2. Pricing Analysis

19.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

19.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

19.4.1. By Material Type

19.4.2. By Application

19.4.3. By End Use

19.4.4. By Function

19.4.5. By Installation

19.4.6. By Country

19.4.6.1. India

19.4.6.2. ASEAN

19.4.6.3. ANZ

19.4.6.4. Rest of South Asia & Pacific

19.5. Market Attractiveness Analysis

19.5.1. By Material Type

19.5.2. By Application

19.5.3. By End Use

19.5.4. By Function

19.5.5. By Installation

19.5.6. By Country

19.6. Market Trends

19.7. Key Market Participants – Intensity Mapping

20. Middle East and Africa Market Outlook, 2019 – 2032

20.1. Introduction

20.2. Pricing Analysis

20.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

20.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

20.4.1. By Material Type

20.4.2. By Application

20.4.3. By End Use

20.4.4. By Function

20.4.5. By Installation

20.4.6. By Country

20.4.6.1. GCC Countries

20.4.6.2. Turkey

20.4.6.3. Northern Africa

20.4.6.4. South Africa

20.4.6.5. Rest of Middle East and Africa

20.5. Market Attractiveness Analysis

20.5.1. By Material Type

20.5.2. By Application

20.5.3. By End Use

20.5.4. By Function

20.5.5. By Installation

20.5.6. By Country

20.6. Market Trends

20.7. Key Market Participants – Intensity Mapping

21. Country Wise Market Analysis

21.1. U.S. Market Analysis

21.1.1. By Material Type

21.1.2. By Application

21.1.3. By End Use

21.1.4. By Function

21.1.5. By Installation

21.2. Canada Market Analysis

21.2.1. By Material Type

21.2.2. By Application

21.2.3. By End Use

21.2.4. By Function

21.2.5. By Installation

21.3. Mexico Market Analysis

21.3.1. By Material Type

21.3.2. By Application

21.3.3. By End Use

21.3.4. By Function

21.3.5. By Installation

21.4. Brazil Market Analysis

21.4.1. By Material Type

21.4.2. By Application

21.4.3. By End Use

21.4.4. By Function

21.4.5. By Installation

21.5. Germany Market Analysis

21.5.1. By Material Type

21.5.2. By Application

21.5.3. By End Use

21.5.4. By Function

21.5.5. By Installation

21.6. Italy Market Analysis

21.6.1. By Material Type

21.6.2. By Application

21.6.3. By End Use

21.6.4. By Function

21.6.5. By Installation

21.7. France Market Analysis

21.7.1. By Material Type

21.7.2. By Application

21.7.3. By End Use

21.7.4. By Function

21.7.5. By Installation

21.8. U.K. Market Analysis

21.8.1. By Material Type

21.8.2. By Application

21.8.3. By End Use

21.8.4. By Function

21.8.5. By Installation

21.9. Spain Market Analysis

21.9.1. By Material Type

21.9.2. By Application

21.9.3. By End Use

21.9.4. By Function

21.9.5. By Installation

21.10. Russia Market Analysis

21.10.1. By Material Type

21.10.2. By Application

21.10.3. By End Use

21.10.4. By Function

21.10.5. By Installation

21.11. BENELUX Market Analysis

21.11.1. By Material Type

21.11.2. By Application

21.11.3. By End Use

21.11.4. By Function

21.11.5. By Installation

21.12. China Market Analysis

21.12.1. By Material Type

21.12.2. By Application

21.12.3. By End Use

21.12.4. By Function

21.12.5. By Installation

21.13. Japan Market Analysis

21.13.1. By Material Type

21.13.2. By Application

21.13.3. By End Use

21.13.4. By Function

21.13.5. By Installation

21.14. S. Korea Market Analysis

21.14.1. By Material Type

21.14.2. By Application

21.14.3. By End Use

21.14.4. By Function

21.14.5. By Installation

21.15. India Market Analysis

21.15.1. By Material Type

21.15.2. By Application

21.15.3. By End Use

21.15.4. By Function

21.15.5. By Installation

21.16. ASEAN Market Analysis

21.16.1. By Material Type

21.16.2. By Application

21.16.3. By End Use

21.16.4. By Function

21.16.5. By Installation

21.17. ANZ Market Analysis

21.17.1. By Material Type

21.17.2. By Application

21.17.3. By End Use

21.17.4. By Function

21.17.5. By Installation

21.18. GCC Countries Thermoplastic Decorative Films Market Analysis

21.18.1. By Material Type

21.18.2. By Application

21.18.3. By End Use

21.18.4. By Function

21.18.5. By Installation

21.19. Turkey Thermoplastic Decorative Films Market Analysis

21.19.1. By Material Type

21.19.2. By Application

21.19.3. By End Use

21.19.4. By Function

21.19.5. By Installation

21.20. South Africa Market Analysis

21.20.1. By Material Type

21.20.2. By Application

21.20.3. By End Use

21.20.4. By Function

21.20.5. By Installation

22. Market Structure Analysis

22.1. Market Analysis by Tier of Companies

22.2. Market Concentration

22.3. Market Share Analysis of Top Players

22.4. Market Presence Analysis

22.4.1. By Regional footprint of Players

22.4.2. Product foot print by Players

23. Competition Analysis

23.1. Competition Dashboard

23.2. Competition Benchmarking

23.3. Competition Key Developments

23.4. Competition Deep Dive

23.4.1. LG Hausys, Ltd.

23.4.1.1. Overview

23.4.1.2. Product Portfolio

23.4.1.3. Sales Footprint

23.4.1.4. Strategy Overview

23.4.2. Renolit

23.4.2.1. Overview

23.4.2.2. Product Portfolio

23.4.2.3. Sales Footprint

23.4.2.4. Strategy Overview

23.4.3. Hanwha L&C

23.4.3.1. Overview

23.4.3.2. Product Portfolio

23.4.3.3. Sales Footprint

23.4.3.4. Strategy Overview

23.4.4. Klockner Pentaplast Group

23.4.4.1. Overview

23.4.4.2. Product Portfolio

23.4.4.3. Sales Footprint

23.4.4.4. Strategy Overview

23.4.5. Omnova Solutions

23.4.5.1. Overview

23.4.5.2. Product Portfolio

23.4.5.3. Sales Footprint

23.4.5.4. Strategy Overview

23.4.6. Avery Denission

23.4.6.1. Overview

23.4.6.2. Product Portfolio

23.4.6.3. Sales Footprint

23.4.6.4. Strategy Overview

23.4.7. Peiyu Plastic Corporation

23.4.7.1. Overview

23.4.7.2. Product Portfolio

23.4.7.3. Sales Footprint

23.4.7.4. Strategy Overview

23.4.8. Mondoplastico S.p.A.

23.4.8.1. Overview

23.4.8.2. Product Portfolio

23.4.8.3. Sales Footprint

23.4.8.4. Strategy Overview

23.4.9. AVI Global Plast Pvt. Ltd.

23.4.9.1. Overview

23.4.9.2. Product Portfolio

23.4.9.3. Sales Footprint

23.4.9.4. Strategy Overview

23.4.10. Ergis Group

23.4.10.1. Overview

23.4.10.2. Product Portfolio

23.4.10.3. Sales Footprint

23.4.10.4. Strategy Overview

23.4.11. Macro Plastic Sdn. Bhd.

23.4.11.1. Overview

23.4.11.2. Product Portfolio

23.4.11.3. Sales Footprint

23.4.11.4. Strategy Overview

23.4.12. Jindal Group

23.4.12.1. Overview

23.4.12.2. Product Portfolio

23.4.12.3. Sales Footprint

23.4.12.4. Strategy Overview

23.4.13. Konrad Hornschuch AG

23.4.13.1. Overview

23.4.13.2. Product Portfolio

23.4.13.3. Sales Footprint

23.4.13.4. Strategy Overview

23.4.14. Fine Decor GmbH

23.4.14.1. Overview

23.4.14.2. Product Portfolio

23.4.14.3. Sales Footprint

23.4.14.4. Strategy Overview

23.4.15. Alfatherm s.p.a.

23.4.15.1. Overview

23.4.15.2. Product Portfolio

23.4.15.3. Sales Footprint

23.4.15.4. Strategy Overview

23.4.16. C.I. TAKIRON Corporation

23.4.16.1. Overview

23.4.16.2. Product Portfolio

23.4.16.3. Sales Footprint

23.4.16.4. Strategy Overview

23.4.17. RTP Company, Inc.

23.4.17.1. Overview

23.4.17.2. Product Portfolio

23.4.17.3. Sales Footprint

23.4.17.4. Strategy Overview

23.4.18. Schweitzer-Mauduit International, Inc. (SWM)

23.4.18.1. Overview

23.4.18.2. Product Portfolio

23.4.18.3. Sales Footprint

23.4.18.4. Strategy Overview

23.4.19. Covestro AG

23.4.19.1. Overview

23.4.19.2. Product Portfolio

23.4.19.3. Sales Footprint

23.4.19.4. Strategy Overview

23.4.20. LyondellBasell Industries Holdings N.V.

23.4.20.1. Overview

23.4.20.2. Product Portfolio

23.4.20.3. Sales Footprint

23.4.20.4. Strategy Overview

23.4.21. Nihon Matai Co., Ltd.

23.4.21.1. Overview

23.4.21.2. Product Portfolio

23.4.21.3. Sales Footprint

23.4.21.4. Strategy Overview

23.4.22. PROTECHNIC SA

23.4.22.1. Overview

23.4.22.2. Product Portfolio

23.4.22.3. Sales Footprint

23.4.22.4. Strategy Overview

23.4.23. Victrex plc.

23.4.23.1. Overview

23.4.23.2. Product Portfolio

23.4.23.3. Sales Footprint

23.4.23.4. Strategy Overview

24. Assumptions and Acronyms Used

25. Research Methodology