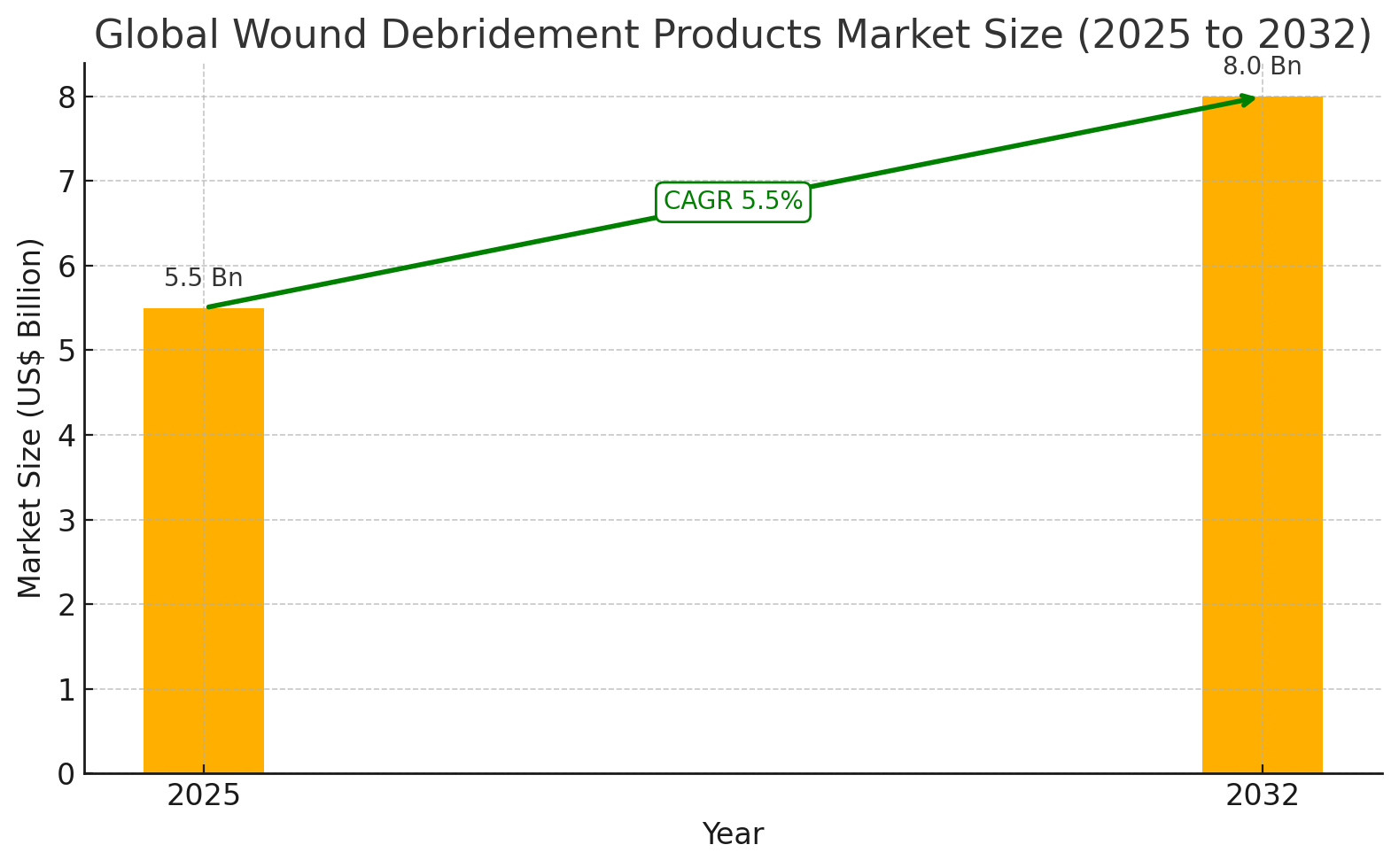

Global Wound Debridement Products Market Overview (2025–2032)

The global wound debridement products market is projected to grow from USD 5.5 billion in 2025 to USD 8.0 billion by 2032, reflecting a compound annual growth rate (CAGR) of 5.5%. Growth is primarily driven by the rising prevalence of chronic wounds, aging populations, and advancements in non-invasive wound care technologies. Chronic conditions such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers are fueling demand for effective debridement solutions that accelerate healing and reduce infection risks.

Wound debridement is a critical step in wound management, removing necrotic or infected tissue to facilitate tissue regeneration. As healthcare systems place increasing emphasis on reducing hospital readmissions and improving patient outcomes, there is growing adoption of advanced debridement products, including mechanical, enzymatic, and ultrasonic solutions.

The market is also benefiting from the integration of artificial intelligence in wound assessment. AI-driven tools allow clinicians to evaluate wound progression, determine the best treatment pathway, and ensure evidence-based care. Companies such as Swift Medical and WoundVision have introduced imaging and thermal technologies that enable early detection and precise intervention.

A major driver of market growth is the increasing global burden of chronic wounds. Diabetic foot ulcers alone affect between 40 to 60 million individuals worldwide annually, while venous leg ulcers are responsible for around 600,000 cases each year in the U.S. The healthcare burden associated with chronic wounds is significant, with recurrence rates as high as 33% and treatment costs reaching billions annually. These challenges are driving demand for innovative, cost-effective debridement products that promote faster healing and reduce complications.

In addition to clinical efficacy, cost remains a major consideration. Advanced technologies such as hydrosurgical and ultrasonic systems can be expensive and are not always accessible in low-resource environments. Variability in wound characteristics, such as biofilm formation and comorbid conditions, also complicates treatment. These factors may limit adoption, especially in emerging markets.

Nevertheless, the industry is seeing a surge in research collaborations and government-backed funding. Research institutions are partnering with healthcare firms to develop specialized solutions. In December 2024, Michigan State University received a $200,000 grant in partnership with Corewell Health to develop a next-generation biomimetic dressing for chronic wounds, demonstrating strong institutional commitment to innovation.

Product-wise, mechanical debridement pads are expected to account for 30.9% of the market in 2025, owing to their ability to effectively remove dead tissue and promote healing. These products are gaining popularity due to ease of use, low cost, and enhanced patient comfort. New designs are incorporating antimicrobial layers and moisture-retaining features to optimize performance.

Biological debridement products, such as maggot therapy, are also seeing increased usage, particularly among patients who are not candidates for surgical procedures. These alternatives preserve healthy tissue while accelerating granulation, making them attractive for managing complex wounds.

Application-wise, chronic ulcers are forecast to represent 48.1% of the global market in 2025, with diabetes as a key contributing factor. The International Diabetes Federation estimates that the number of adults living with diabetes will rise from 537 million in 2021 to 783 million by 2045. Diabetic patients are more susceptible to foot ulcers, while the elderly are more prone to pressure ulcers. These trends are driving demand for both autolytic and enzymatic debridement products that promote healing while minimizing patient discomfort.

Surgical wounds, though a smaller segment, are projected to grow significantly. Post-operative wounds from orthopedic, cesarean, and cancer surgeries require precise wound management to prevent bacterial colonization. Debridement is essential in these cases to avoid complications such as sepsis or prolonged hospital stays.

Regionally, North America is expected to dominate with a 45.1% market share in 2025, led by the United States. A high prevalence of chronic wounds, strong healthcare infrastructure, and early adoption of new technologies are propelling regional growth. Companies like Smith & Nephew continue to launch enzymatic gels and smart dressings, enhancing chronic wound care capabilities.

Europe is expected to hold 28.1% of the global market, with Germany emerging as a key contributor due to its high number of chronic wound cases—nearly 4 million annually. Ongoing partnerships between European firms and wound care centers are accelerating the development of novel enzymatic and bioactive debridement products.

Asia Pacific is projected to hold a 20.3% share, driven by healthcare investment in countries such as China and India. In China, the National Medical Products Administration allocated $150 million in 2024 to support biotech firms focused on wound care innovation. In India, the prevalence of road accidents and burn injuries is generating robust demand for surgical and enzymatic debridement.

The market is highly competitive, with major players including Smith+Nephew, Mölnlycke, Coloplast, B. Braun, and Medline Industries. Companies are pursuing product innovation, clinical research, and strategic partnerships to expand their global footprint and improve clinical outcomes. Investment in AI, biosensor integration, and smart dressings is expected to further reshape the competitive landscape.

Notable industry developments include MediWound’s Phase II study of EscharEx® against collagenase for treating venous leg ulcers, and Remedium Healthcare’s April 2024 launch of a sacral silicone dressing available via Amazon. These initiatives highlight the industry’s commitment to accessibility, innovation, and precision care.

As global awareness around chronic wound care continues to rise, manufacturers, healthcare providers, and governments are working collaboratively to deliver scalable, patient-centered solutions. The forecast period will likely witness broader adoption of high-performance debridement products, offering faster recovery, fewer complications, and improved quality of life for millions of patients worldwide.

Table of Content

- Executive Summary

- Global Wound Debridement Products Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2024 – 2032, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- Macro-Economic Factors

- Global Sectorial Outlook

- Global GDP Growth Outlook

- COVID-19 Impact Analysis

- Forecast Factors – Relevance and Impact

- Value Added Insights

- Product Adoption Analysis

- Regulatory Landscape

- Value Chain Analysis

- Key Deals and Mergers

- PESTLE Analysis

- Porter’s Five Force Analysis

- Price Trend Analysis, 2019 – 2032

- Key Highlights

- Key Factors Impacting Product Prices

- Pricing Analysis, By Product

- Regional Prices and Product Preferences

- Global Wound Debridement Products Market Outlook:

- Key Highlights

- Market Volume (Units) Projections

- Market Size (US$ Bn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Bn) Analysis and Forecast

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, 2025-2032

- Global Wound Debridement Products Market Outlook: Product

- Introduction / Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, By Product, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product, 2025-2032

- Surgical Wound Debridement Devices

- Non-surgical Wound Debridement Devices

- Low-frequency Ultrasound Devices

- Mechanical Debridement Pads

- Biological Debridement Products

- Autolytic Debridement Products

- Enzymatic Debridement Products

- Market Attractiveness Analysis: Product

- Global Wound Debridement Products Market Outlook: Application

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Application, 2019-2024

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Chronic Ulcers

- Surgical Wounds

- Traumatic Wounds

- Burn Cases

- Others

- Market Attractiveness Analysis: Application

- Global Wound Debridement Products Market Outlook: End User

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By End User, 2019-2024

- Current Market Size (US$ Bn) Analysis and Forecast, By End User, 2025-2032

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Nursing Facilities

- Others

- Market Attractiveness Analysis: End User

- Key Highlights

- Global Wound Debridement Products Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, By Region, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Region, 2025-2032

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Wound Debridement Products Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product

- By Application

- By End User

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Country, 2025-2032

- U.S.

- Canada

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product, 2025-2032

- Surgical Wound Debridement Devices

- Non-Surgical Wound Debridement Devices

- Low-Frequency Ultrasound Devices

- Mechanical Debridement Pads

- Biological Debridement Products

- Autolytic Debridement Products

- Enzymatic Debridement Products

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Chronic Ulcers

- Surgical Wounds

- Traumatic Wounds

- Burn Cases

- Others

- Current Market Size (US$ Bn) Analysis and Forecast, By End User, 2025-2032

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Nursing Facilities

- Others

- Market Attractiveness Analysis

- Europe Wound Debridement Products Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product

- By Application

- By End User

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Country, 2025-2032

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Türkiye

- Rest of Europe

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product, 2025-2032

- Surgical Wound Debridement Devices

- Non-Surgical Wound Debridement Devices

- Low-Frequency Ultrasound Devices

- Mechanical Debridement Pads

- Biological Debridement Products

- Autolytic Debridement Products

- Enzymatic Debridement Products

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Chronic Ulcers

- Surgical Wounds

- Traumatic Wounds

- Burn Cases

- Others

- Current Market Size (US$ Bn) Analysis and Forecast, By End User, 2025-2032

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Nursing Facilities

- Others

- Market Attractiveness Analysis

- East Asia Wound Debridement Products Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product

- By Application

- By End User

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Country, 2025-2032

- China

- Japan

- South Korea

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product, 2025-2032

- Surgical Wound Debridement Devices

- Non-Surgical Wound Debridement Devices

- Low-Frequency Ultrasound Devices

- Mechanical Debridement Pads

- Biological Debridement Products

- Autolytic Debridement Products

- Enzymatic Debridement Products

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Chronic Ulcers

- Surgical Wounds

- Traumatic Wounds

- Burn Cases

- Others

- Current Market Size (US$ Bn) Analysis and Forecast, By End User, 2025-2032

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Nursing Facilities

- Others

- Market Attractiveness Analysis

- South Asia & Oceania Wound Debridement Products Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product

- By Application

- By End User

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Country, 2025-2032

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product, 2025-2032

- Surgical Wound Debridement Devices

- Non-Surgical Wound Debridement Devices

- Low-Frequency Ultrasound Devices

- Mechanical Debridement Pads

- Biological Debridement Products

- Autolytic Debridement Products

- Enzymatic Debridement Products

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Chronic Ulcers

- Surgical Wounds

- Traumatic Wounds

- Burn Cases

- Others

- Current Market Size (US$ Bn) Analysis and Forecast, By End User, 2025-2032

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Nursing Facilities

- Others

- Market Attractiveness Analysis

- Latin America Wound Debridement Products Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product

- By Application

- By End User

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Country, 2025-2032

- Brazil

- Mexico

- Rest of Latin America

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product, 2025-2032

- Surgical Wound Debridement Devices

- Non-Surgical Wound Debridement Devices

- Low-Frequency Ultrasound Devices

- Mechanical Debridement Pads

- Biological Debridement Products

- Autolytic Debridement Products

- Enzymatic Debridement Products

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Chronic Ulcers

- Surgical Wounds

- Traumatic Wounds

- Burn Cases

- Others

- Current Market Size (US$ Bn) Analysis and Forecast, By End User, 2025-2032

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Nursing Facilities

- Others

- Market Attractiveness Analysis

- Middle East & Africa Wound Debridement Products Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Product

- By Application

- By End User

- Current Market Size (US$ Bn) and Volume (Units) and Forecast, By Country, 2025-2032

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Product, 2025-2032

- Surgical Wound Debridement Devices

- Non-Surgical Wound Debridement Devices

- Low-Frequency Ultrasound Devices

- Mechanical Debridement Pads

- Biological Debridement Products

- Autolytic Debridement Products

- Enzymatic Debridement Products

- Current Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Chronic Ulcers

- Surgical Wounds

- Traumatic Wounds

- Burn Cases

- Others

- Current Market Size (US$ Bn) Analysis and Forecast, By End User, 2025-2032

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Nursing Facilities

- Others

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details – Overview, Financials, Strategy, Recent Developments)

- Smith+Nephew

- Overview

- Segments and Products

- Key Financials

- Market Developments

- Market Strategy

- Maveramedical

- Mölnlycke AB

- Arobella Medical LLC

- Bioevopeak Co., Ltd.

- EZDebride

- Coloplast A/S

- Medline Industries, Inc.

- B. Braun Melsungen AG

- Lohmann & Rauscher

- Histologics, LLC

- Klinion

- Convatec Inc.

- Synerheal Pharmaceuticals

- AQF Medical

- Coloplast Ltd

- Advanced Medical Solutions Group plc

- NetMed S.à.r.l.

- Welcare Industries S.p.A

- PAUL HARTMANN Pty. Ltd

- Mediq UK.

- Smith+Nephew

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations